link.

link.Create LOC Application

Please Note:

Applications will only enter the queue to be reviewed on a first come, first served basis once all required information and documentation has been entered and uploaded.

Applications can be made for prior taxation years as long as that taxation year is not statute barred. To determine statute barred status, the applicant can contact Canada Revenue Agency (CRA). If not statue barred, the applicant can amend a previously filed tax return with CRA, with the estimated amount of the OFTTC on the certificate entered. It is the applicant’s responsibility to ensure that they are not statute barred from amending a tax return for a previous fiscal year. Please consult the CRA website for more information on statute barred dates at http://www.canada.ca/en/revenue-agency.html or contact the Film Services Unit at 416-973-3407 or 416 954-0542.

Create an LOC Tax Credit Application:

1. Click on the  link.

link.

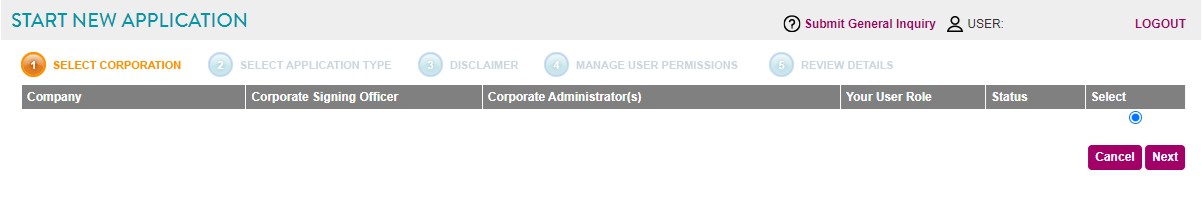

The Applications

page will display as shown below.

2. Using the radial check

boxes under the Select column,

select your desired Company and

click  . The following page will display.

. The following page will display.

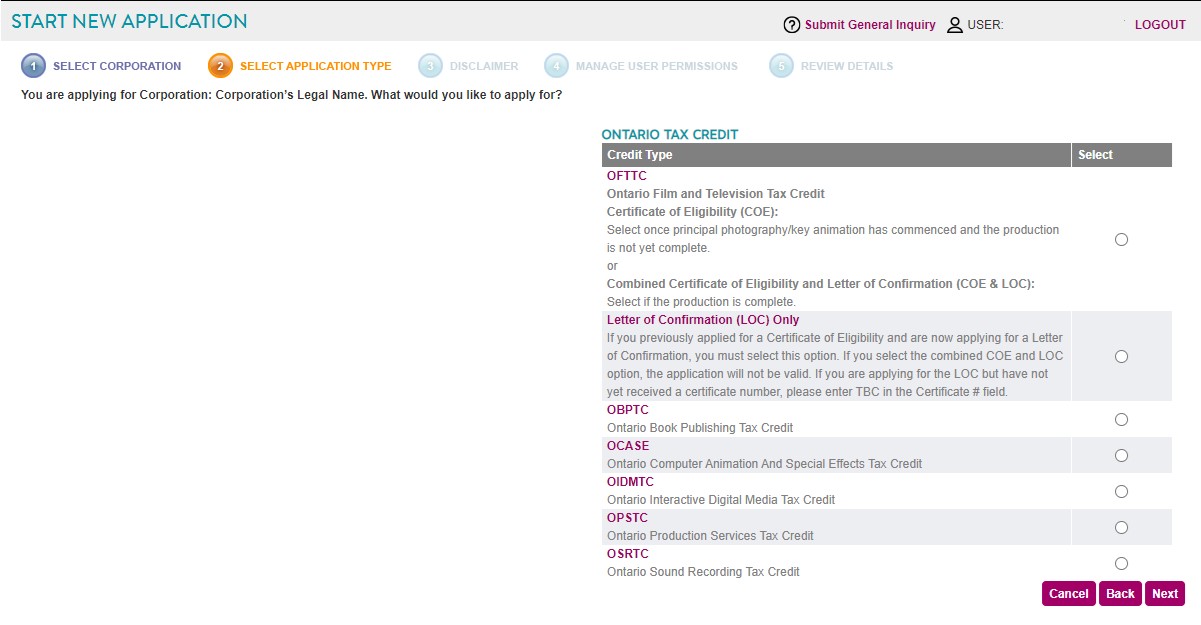

3. Under the Select

column, select LOC and click

.

.

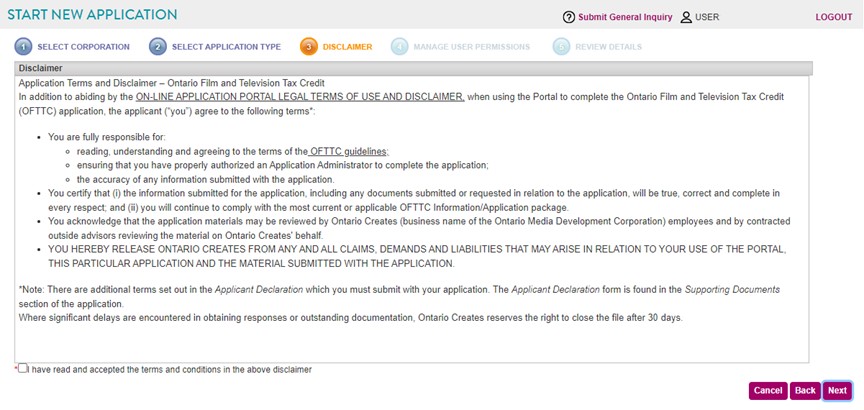

The Disclaimer page will display.

4. Check the "I have read and accepted the terms and conditions

for the above disclaimer" radial box and click  .

.

The Manage Users Permission page will display.

5. Using the Application

check boxes, select the User Permission

and click  . The Review

Details page will display as shown below to ensure the information

you have entered is correct.

. The Review

Details page will display as shown below to ensure the information

you have entered is correct.

6. Click  .

.

Filling out the General and Corporate, Production and Post Production, Producers and Key Creative Personnel, Expenditure, Financing, Distribution and Supporting Documents Sections:

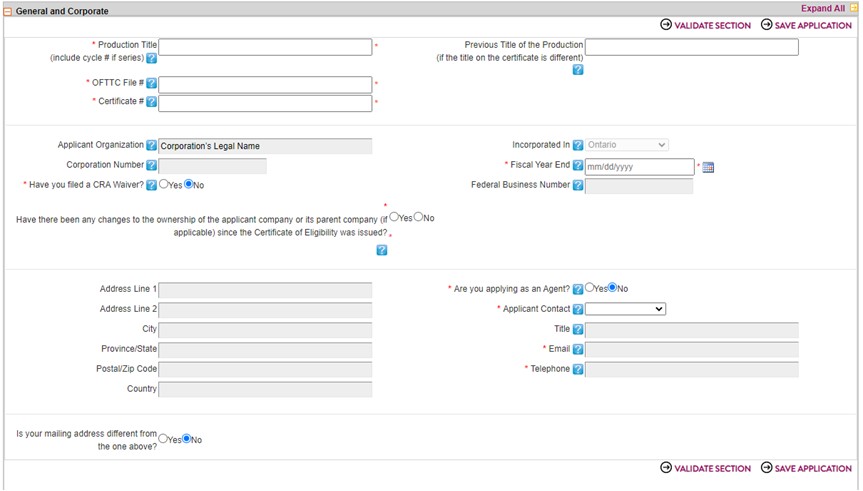

Filling out the General and Corporate section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Add a Row:

To add a row under, click

the  button. Additional fields will display. To remove

a row, simply click the Remove

link.

button. Additional fields will display. To remove

a row, simply click the Remove

link.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validated the content is correctly/incorrectly filled in.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the General Section:

Production Title - Enter the name of the production as it appears on-screen.

Previous Production Title - If the Certificate was issued with a different production title, enter it here.

OFTTC File # - Ontario Creates assigned file number listed on the Certificate.

Certificate # - Ontario Creates assigned number when Certificate was issued.

Applicant Organization - This is the corporation’s legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Incorporated In - This is the jurisdiction where the company is incorporated.

Taxation Year End - Enter the company’s taxation year end following the start of principal photography. Please note the deadlines for the application are calculated based on the taxation year end of the production company. The onus is on the production company to inform Ontario Creates of any change in, or final determination of, the taxat ion year end at the time such change in, or determination of, the taxation year end occurs. Ontario Creates will not be responsible for any failure of the production company to comply with this requirement. Please be aware that an incorrect taxation year end may adversely affect the calculation of application deadlines for the production company.

Corporation Number - This is the number on the Articles of Incorporation.

Federal Business Number - This is the nine digit account number that CRA assigned to the applicant corporation.

Have you filed a CRA Waiver? - CRA Waiver in Respect of the Normal Reassessment Period - (CRA Form T2029) - The applications for both a Certificate of Eligibility and a Letter of Confirmation must be submitted to the Ontario Creates no later than 24 months from the production company’s first taxation year end following the commencement of principal photography. If this application deadline cannot be met, it may be extended to 42 months from the first taxation year end date where the production company has filed a valid Waiver in Respect of the Normal Reassessment Period with the Canada Revenue Agency (CRA Form T2029 available here). The deadline for applications is calculated based on the taxation year end of the production company. The onus is on the production company to inform Ontario Creates of any change in, or final determination of, the taxation year end at the time such change in, or determination of, the taxation year end occurs. Ontario Creates will not be responsible for any failure of the production company to comply with this requirement. Please be aware that an incorrect taxation year end may adversely affect the calculation of these deadlines for the production company.

Are you applying as an Agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicant’s consent.

Applicant Contact - Please select the primary contact from the dropdown list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contact’s title. It can be changed in the User Profile.

Email - This is the contact’s email. It can be changed in the User Profile.

Phone - This is the contact’s telephone. It can be changed in the User Profile.

Definitions for Production and Post Production, Expenditures, Financing and Distribution sections:

Completion Date - The date that the production is completed and commercially exploitable. Enter the completion date of the last episode in the case of a television series.

Total Production Costs - This is the total of Canadian and international costs if the production is a treaty coproduction.

Total Canadian Costs - This is consolidated cost among Canadian jurisdictions in the case of an interprovincial coproduction.

Total Ontario Producers Costs - This is the total Ontario and non-Ontario expenditures of the Ontario Producer.

Total Non-Ontario Costs (Paid by the Ontario Producer) - This is the total of all production costs paid by the applicant company to non-Ontario residents and to facilities and suppliers located and providing services outside Ontario. Note that non-Ontario costs are not necessarily the same as non-Canadian costs for purposes of the CPTC. Per diems and hotel costs for Ontario residents performing services outside of Ontario are considered non-Ontario costs. See. See the What are non-Ontario Costs? FAQ for further details.

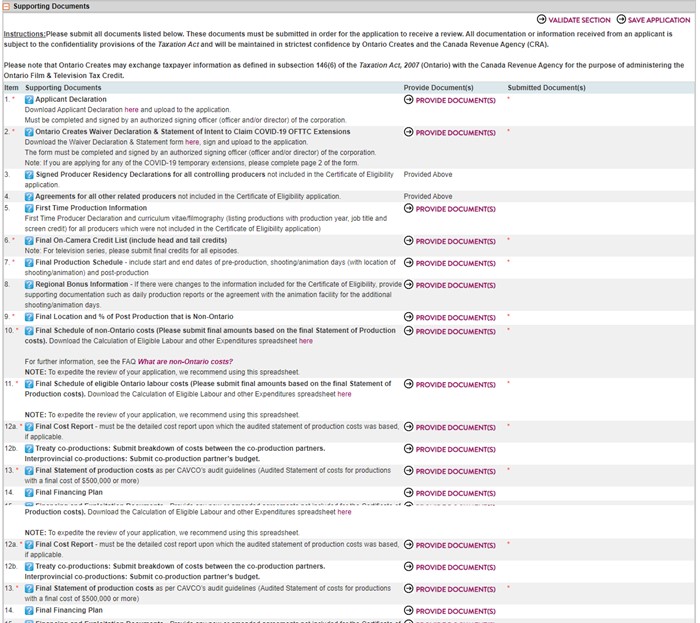

Supporting Documents:

Definitions for Supporting Documents:

Applicant Declaration – Complete a new Declaration for the Letter of Confirmation. The form must be signed by an officer and/or director of the corporation.

Ontario Creates Waiver Declaration & Statement of Intent to Claim COVID-19 Extensions (“Ontario Creates Waiver & COVID Statement”) – The form must be signed by an officer and/or director of the corporation.

The applications for both a Certificate of Eligibility and a Letter of Confirmation must be submitted to the Ontario Creates no later than 24 months from the production company’s first taxation year end following the commencement of principal photography. If this application deadline cannot be met, it may be extended by 18 months, for a total of 42 months from the first taxation year end date following commencement of principal photography, as long as the application is accompanied by a completed Ontario Creates Waiver & COVID Statement attesting that: (1) a Waiver in Respect of the Normal Reassessment Period (CRA Form T2029)* has been filed with the Canada Revenue Agency (CRA) within the normal reassessment period for the first taxation year end following commencement of principal photography (and second year, if applicable); or (2) the first taxation year end following commencement of principal photography (and second year, if applicable); has not yet been assessed by the CRA. If the corporation’s income tax return(s) for the relevant taxation year(s) have not yet been assessed, a valid form T2029 Waiver cannot be filed with the CRA for those years. However, you may still extend the application deadline by 18 months by filing a completed Ontario Creates Waiver & COVID Statement form.

Qualifying productions which were delayed due to COVID-19, may apply for an extension to the 24 month deadline to submit an application for a Certificate of Eligibility, or a Letter of Confirmation, if the Certificate of Eligibility was previously issued, of an additional 24 months, for a total of 48 months from the corporation’s first taxation year end following the commencement of principal photography. Companies will still have the option of extending the 48 month application deadline by an additional period of 18 months, for a total of 66 months from their first taxation year end following the commencement of principal photography. The Certificate of Eligibility and/or the Letter of Confirmation would then have to be issued no later than 6 months later, or 72 months following the corporation’s first taxation year end following the commencement of principal photography.

In order to obtain the 48 months application deadline, you must file a valid Waiver in Respect of the Normal Reassessment Period with the CRA for the first and second taxation years ending after principal photography began. You must also include a completed Ontario Creates Waiver & COVID Statement form for those years with your application for a Certificate of Eligibility, or with your application for a Letter of Confirmation, if the Certificate of Eligibility was previously issued. To extend the 48 months application deadline by an additional 18 months, resulting in an application deadline of 66 months, the corporation must also file valid waivers with the CRA for the third and fourth taxation years ending after principal photography began. A completed Ontario Creates Waiver & COVID Statement for those years must also be included with your application for a Certificate of Eligibility, or with your application for a Letter of Confirmation, if the Certificate of Eligibility was previously issued.

*Waiver in Respect of the Normal Reassessment Period (CRA Form T2029) - If applying for a Certificate of Eligibility and/or Letter of Confirmation after the 24-month deadline but before the 42-month deadline, the production company must file with the CRA a waiver, described in subparagraph 152(4)(a)(ii) of the Income Tax Act, within the normal reassessment period for the corporation (i.e. three years from the date of the Notice of Assessment; four years in the case of a public company) for the first (and second, if applicable) fiscal year end following commencement of principal photography. The Waiver in Respect of the Normal Reassessment Period (CRA Form T2029), is available here. The completed Waiver should be sent to your local CRA Tax Services Office.

Signed Producer Residency Declaration for all controlling Producers not included in the Certificate of Eligibility application - Including but not limited to producers, executive producers, and co-producers. Does not include line producers and associate producers.

Agreements for all other related producers not included in the Certificate of eligibility application - This does not apply to the producers from the other province in an interprovincial co-production.

First Time Production Information - First Time Producer Declaration and curriculum vitae/filmography (listing productions with production year, job title and screen credit) for all producers which were not included in the Certificate of Eligibility application).

Final On-Camera Credit List - Please submit the head and tail credit lists for the production as they appear on screen. If the production is a television series, submit the head and tail credits for every episode.

Final Production Schedule - include start and end dates of pre-production, shooting/animation days (with location of shooting/animation) and post-production.

Regional Bonus Information - If there were changes to the information included for the Certificate of Eligibility, provide supporting documentation such as daily production reports or the agreement with the animation facility for the additional shooting/animation days.

Final Location and % of Post Production that is Non-Ontario - Please confirm how much, if any, of the post production was completed outside Ontario.

Final Schedule of non-Ontario costs - Please submit final amounts based on the final Statement of Production costs.

Final Schedule of Ontario Labour costs - Please submit final amounts based on the final Statement of Production costs.

Final Cost Report - Must be the detailed cost report upon which the audited statement of production costs, if applicable, was based.

IN ADDITION:

For treaty co-productions include a breakdown of final costs between the co-producing partners.

For interprovincial co-productions submit the final cost reports for both the Ontario and co-producing partner(s).

Final Statement of production costs - as per CAVCO’s audit guidelines (Audited Statement of costs for productions with a final cost of $500,000 or more.

Financing and Exploitation Documents - Provide any new or amended agreements which were not included for the Certificate of Eligibility. If only commitment letters were available for the COE, please submit the long form agreements.

Telefilm Final Recommendation - for International Treaty Co-productions.

CAVCO Part A Certificate

Note: Required for exemption(s) for non-Canadian producer(s).

CAVCO Part B certificate (if available):

Note: Required for International Treaty Co-productions.

Copy of the completed production in digital format (either in a playable file format or a downloadable link). Note: For television series, please submit the last episode only.

Other Documents - All other supporting documents that are not listed in the document items above can be uploaded here. If you wish to make any comments, please make note of that in the General Comments field below.

Once you have completed all sections of the Tax

Credit Application, click the  button to submit

your application to Ontario Creates.

button to submit

your application to Ontario Creates.