link.

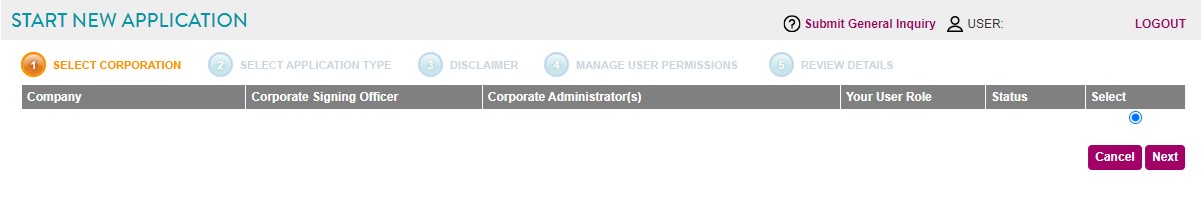

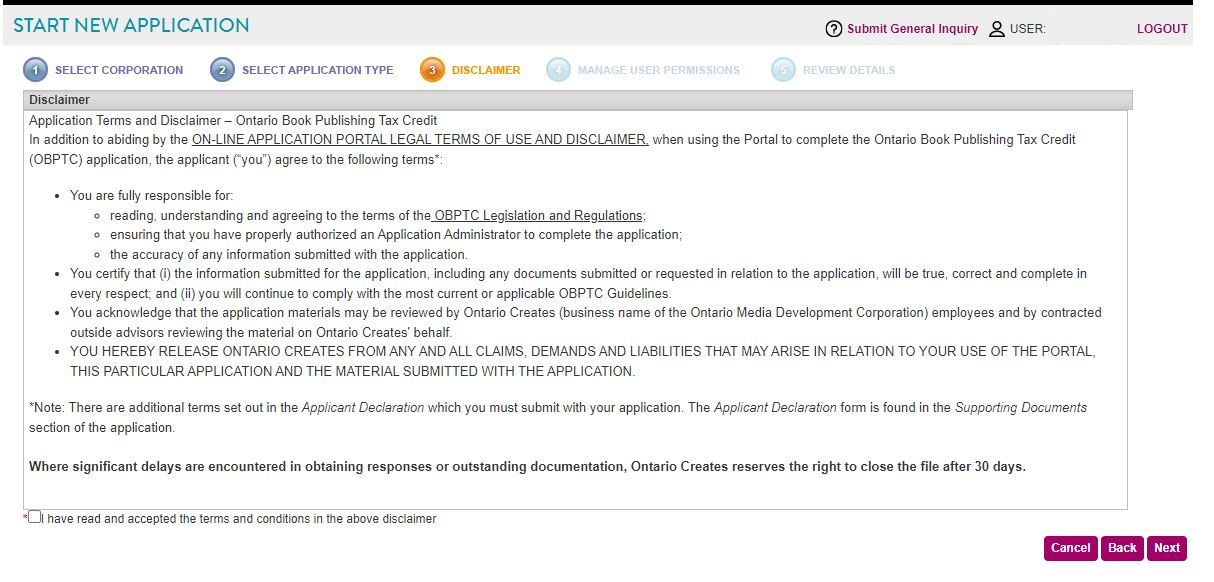

link.The Applications page will display as shown below.

Create OBPTC Tax Credit Application

Please Note:

Applications will only enter the queue to be reviewed on a first-come, first-served basis once all required information and documentation has been entered and uploaded.

All Ontario Creates tax credit applications must be submited via our Online Application Portal and all requested documents must be uploaded through the portal.

A red Asterix * beside a field in the application form, or beside checklist items for requested documents indicates that those items are mandatory and must be completed or those specific documents must be attached in order to proceed with the application.

Create an OBPTC Tax Credit Application:

1. Click on the  link.

link.

The Applications page will display as shown below.

2. Using the radial check

boxes under the Select column,

select your desired Company and

click  . The following page will display.

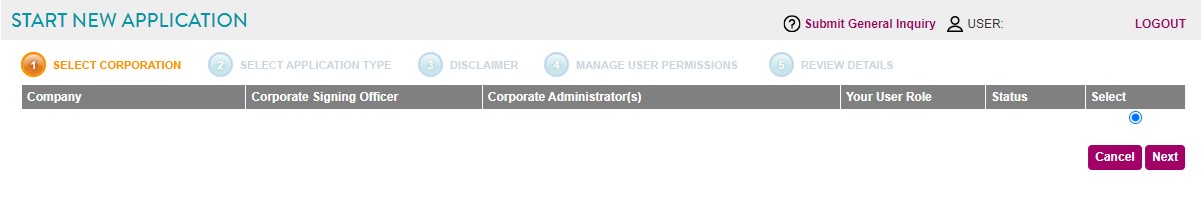

. The following page will display.

3. Under the Select

column, select OBPTC and click

.

.

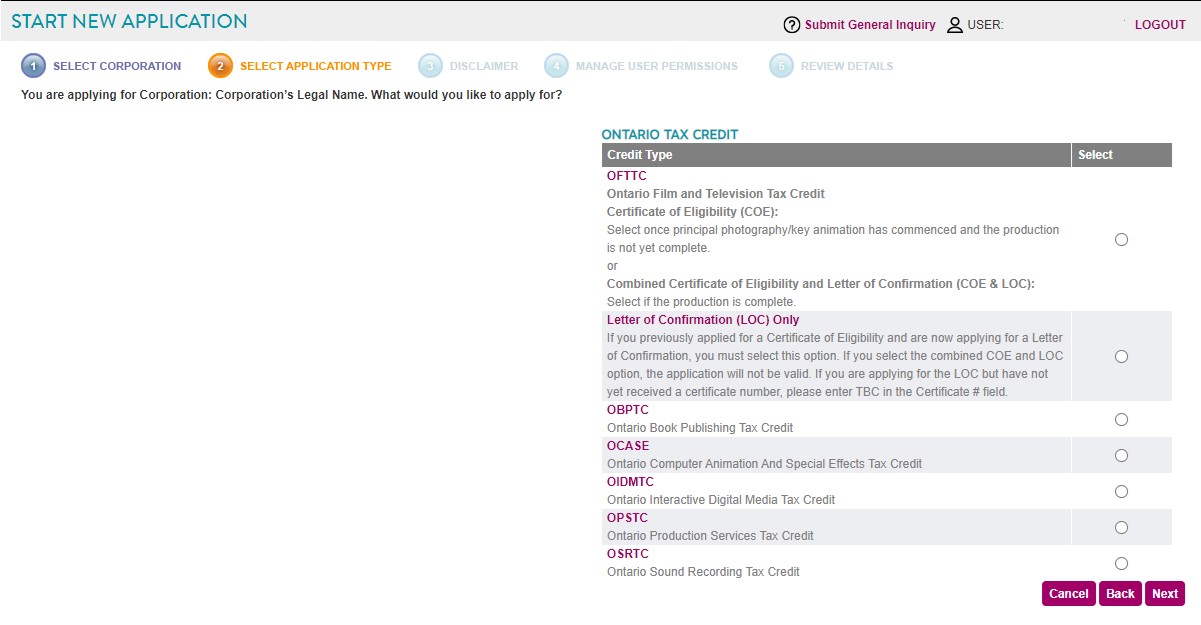

The Disclaimer page will display.

4. Check the "I have read and accepted the terms and conditions

for the above disclaimer" radial box and click  .

.

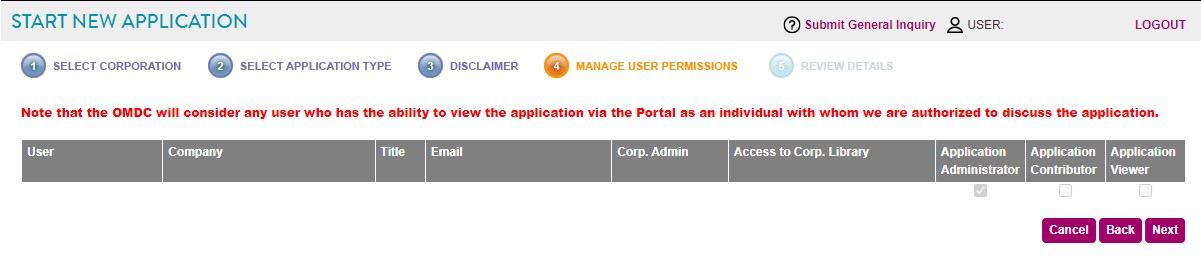

The Manage Users Permission page will display.

5. Using the Application

check boxes, select the User Permission

and click  . The Review

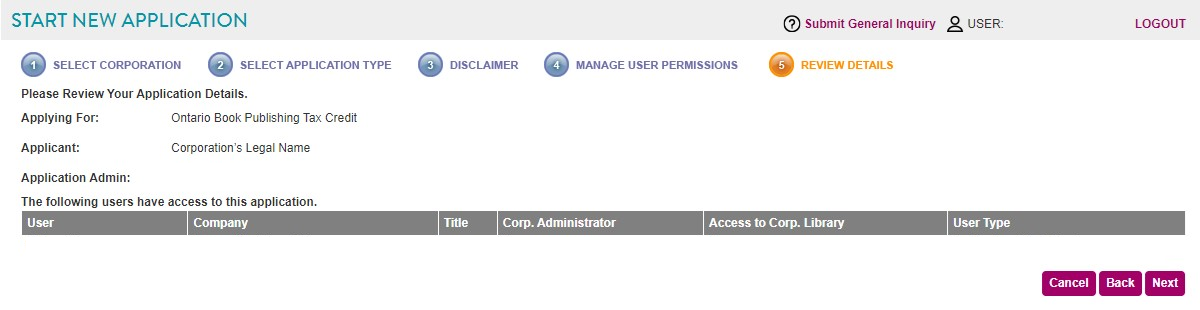

Details page will display as shown below to ensure the information

you have entered is correct.

. The Review

Details page will display as shown below to ensure the information

you have entered is correct.

6. Click  .

.

Filling out the General, Corporation Details, Book Details, Calculation of OBPTC Estimate, Administration Fee and Supporting Documents Sections:

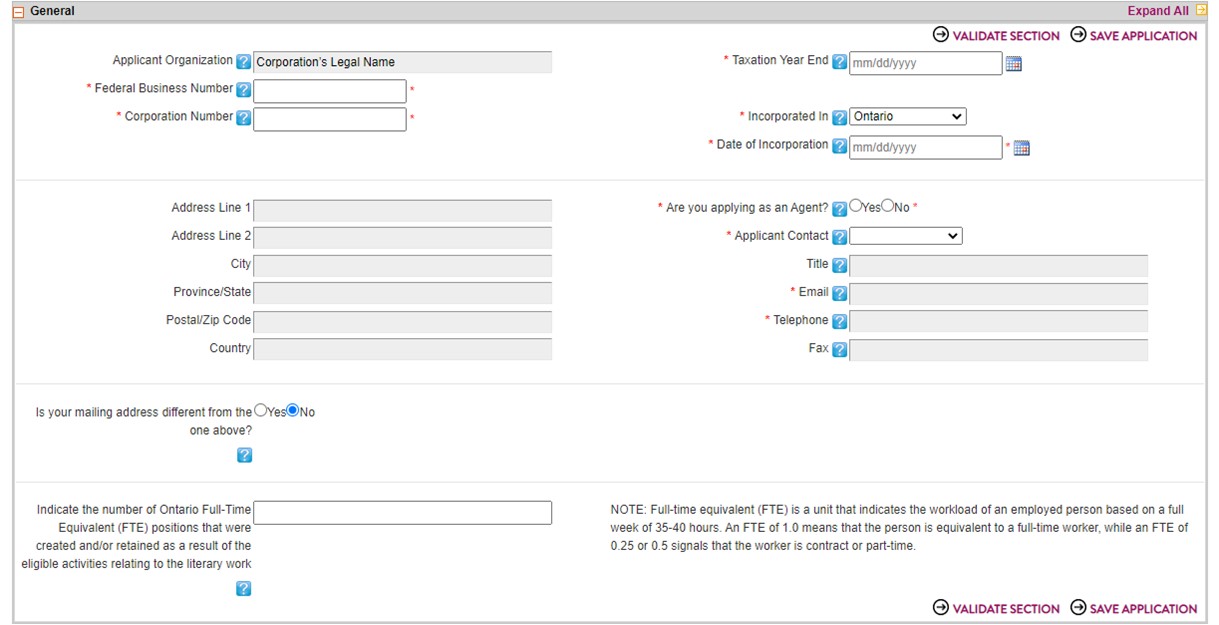

Filling out the General section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validated the content is correctly/incorrectly filled in.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the General Section:

Application Organization - This is the corporation’s legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Taxation year end - Enter the end of your company’s taxation year for the current application. If you have not filed a corporate tax return yet, please enter the anticipated year end date.

Federal business number - This is the nine digit account number that CRA assigned to the applicant corportion.

Corporation number - This is the number on the Articles of Incorporation.

Incorporated in - This is the jurisdiction where the company is incorporated.

Date of Incorporation - This is the date when the company was incorporated.

Are you applying as an agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicant’s consent.

Applicant contact - Please select the primary contact from the drop-down list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contact’s title. It can be changed in the User Profile.

Email - This is the contact’s email address. It can be changed in the User Profile.

Telephone - This is the contact’s telephone number. It can be changed in the User Profile.

Indicate the number of Ontario Full-Time Equivalent (FTE) positions - The provincial government has requested that Ontario Creates collect this data to understand the impact of support to these sectors.

An FTE is defined as a work week of approximately 35-40 weeks over the life of the project. For example:

• If an individual was engaged on the project for about 20 hours a week, they would be considered 0.5 (or half) an FTE.

• If an individual worked 35-40 hours a week but only worked for half of the production length, then they would also be a half an FTE.

Is your mailing address different from the one above? - If “Yes”, please provide different address in the space provided.

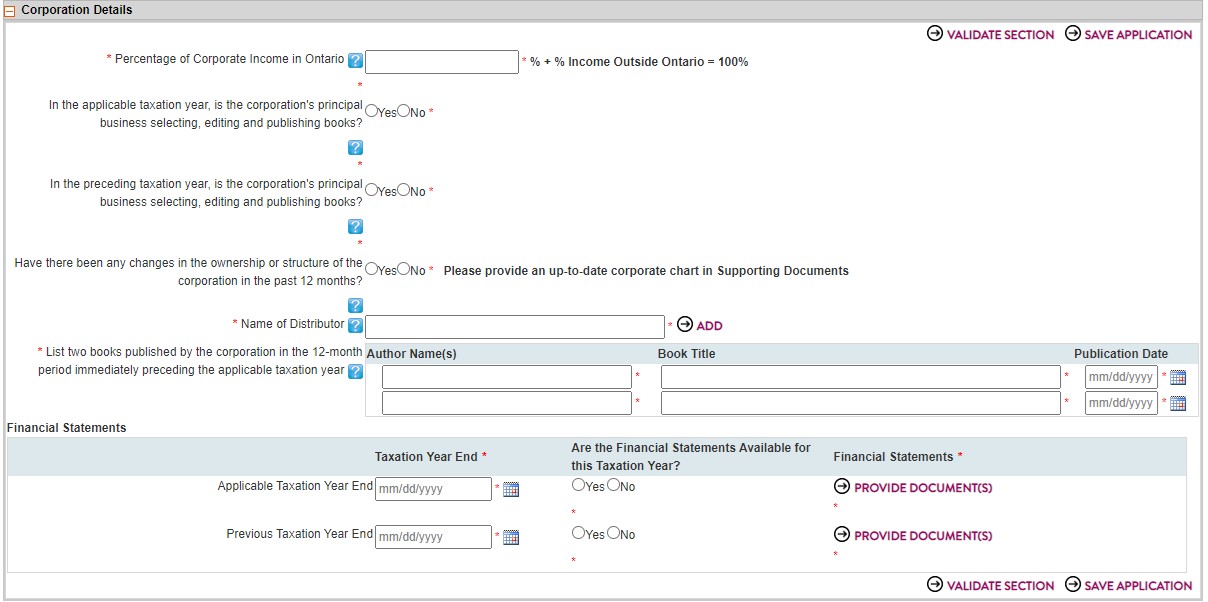

Filling out the Corporate Details Section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the Corporate Details Section:

Percentage of corporate income in Ontario - Enter the percentage of your corporate income which was earned in Ontario and claimed for the preceding fiscal year on the corporate tax return.

In the applicable taxation

year, is the corporation's principal business selecting, editing and publishing

books? - A corporation is considered to be a book publishing company if it’s principal business is selecting, editing, and publishing books.

The business of publishing includes creating original literary or scholarly works through contractual agreements with Canadian authors and illustrators and other copyright holders,

printing these literary and scholarly. See Section 95 (20) of the Taxation Act, 2007 and OBPTC Guidelines for further details.

In the preceding taxation year,

is the corporation's principal business selecting, editing and publishing

books? - - See information provided in the question related to the applicable taxation year. Book publishing company is defined in Section 95 (20) Taxation Act, 2007. See OBPTC Guidelines. Have there been any changes in the ownership or structure of the corporation in the past 12 months? - If yes, please provide an up-to-date corporate chart in Supporting Documents. List two books published

by the corporation in the 12 month period immediately preceding the applicable

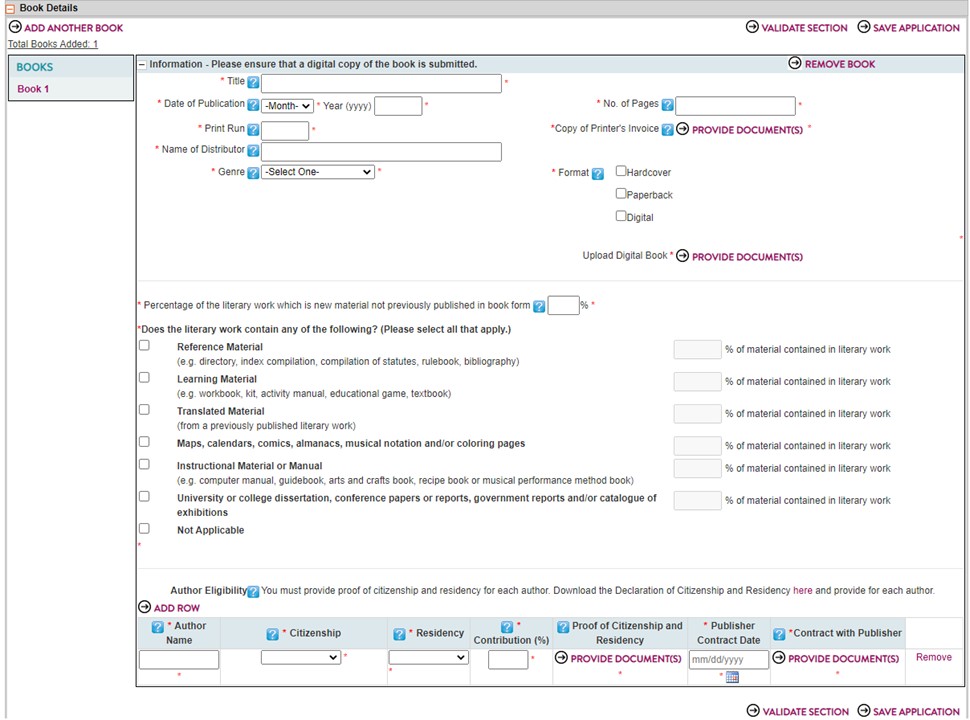

taxation year -The applicable taxation year is the year in which the tax credit is being claimed. Filling out the Book Details Section: Fill in all the applicable

information as shown below. Note: You may click

the Save Application button as

often as you need. After you have filled in a section on ANY

Tax Credit Form, click the Add a Row: To add a row under, click

the If you are unclear about a certain field, click the Add Another Book: Click the Click OK or click

Cancel. Definitions for the Book Details Section: Title -

State full title including subtitle. ISBN - Include 13-digit ISBNs for hardcover and paperback formats, and digital format ISBNs (if applicable). Date of publication - Enter Publication Date. No. of Pages

- Enter total number of pages. Print run - Enter print run. This information is not required if the book was published after December 31, 2019 in a digital format only. Name of distributor - In order to be eligible for the OBPTC, the corporation must offer the book for sale through an established distributor. An established distributor is defined as a person or partnership that has engaged in the business of selling or distributing books to retail stores and educational institutions for more than one year and does not sell directly by retail to an ultimate consumer. (See OBPTC Guidelines and Section 95 (20) Taxation Act, 2007). Genre - Eligible categories of writing are fiction, nonfiction, poetry, biography, children’s fiction, children’s nonfiction, children’s poetry and children’s biography. Format - Indicate which formats the book was published in. Percentage of the current literary work which is new material not previous published in book form - Includes

material previously published in anthologies. Percentage of text to picture for the literary work - Please indicate the percentage of text and the percentage of pictures within the literary work. The resulting total must equal 100%. Author Eligibility

- Author includes, in respect of a literary work that is a children’s book, the illustrator of the literary work. An eligible Canadian author is an individual who at the time the contract is entered into to publish the book, is ordinarily resident in Canada and is a Canadian citizen or is a permanent resident within the meaning of the Immigration and Refugee Protection Act (Canada). An author who is a Canadian citizen but resides outside of Canada will not be considered to be an eligible Canadian author. An author may have more than one residence, but must be “ordinarily resident” in Canada, within the meaning of the Income Tax Act, in order to be considered an eligible Canadian author. (See OBPTC Guidelines and Section 95 (20) of the Taxation Act, 2007.) Author Name

- Enter author’s name and include any known aliases. Citizenship -

Eligible authors must be Canadian citizens or permanent residents. Residency -

Eligible authors must be ordinarily residents in Canada at the time the contract to publish the book was entered into. Contribution %

- If written by more than one author, allocate each author’s percentage

of contribution. Proof of citizenship and residency - Please provide a signed and dated Declaration of Citizenship & Residency for each author. Contract

with Publisher - Provide contract(s) with all authors to publish

the current literary work. For anthologies you can provide contract with

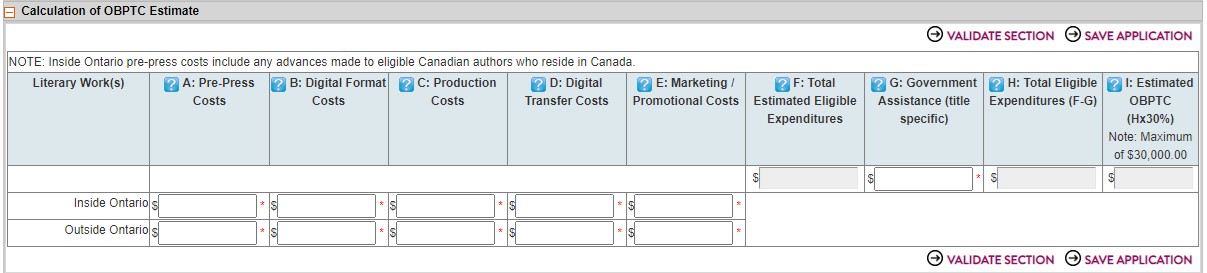

the editor. Filling out the Calculation of OBPTC Estimate Section: Fill in all the applicable

information as shown below. Definitions for the Calculation of OBPTC Estimate Section: A: Pre-press costs incurred in Ontario - Total pre-press expenditures incurred in Ontario that reasonably related to the publishing of the literary work. Pre-press costs include non-refundable author advances, and amounts for the following activities, if they were carried out primarily in Ontario: A: Pre-press costs incurred outside Ontario - Total pre-press expenditures incurred outside Ontario that reasonably related to the publishing of the literary work. B: Digital format costs incurred in Ontario -

Total digital expenditures incurred in Ontario that reasonably related to preparing a literary work for publication in one or more digital or electronic formats. B: Digital format costs incurred outside Ontario -

Total digital expenditures incurred outside Ontario that reasonably related to preparing a literary work for publication in one or more digital or electronic formats. C: Production costs incurred in Ontario - Total expenditures incurred in Ontario for the printing, assembling and binding of the literary work.

Whether an activity is carried out primarily in Ontario is a question of fact.

If more than 50% of the costs of an activity are incurred in Ontario, the activity is generally considered to be carried out primarily in Ontario.

However, where the printing of a book is done outside of Ontario and the paper is supplied from an Ontario company, this activity is not considered to be carried out primarily in Ontario even if the paper cost is more than 50% of the total cost of the print job. Qualifying expenditures are listed in Section 95 (16) Taxation Act, 2007. See OBPTC Guidelines for further details. C: Production costs incurred outside Ontario - Total expenditures incurred outside Ontario for the printing, assembling and binding of the literary work. D: Digital transfer costs incurred in Ontario

- Total expenditures incurred in Ontario that reasonably relate to transferring a prepared digital or electronic version of the literary work into or onto a form suitable for distribution, if those activities are carried out primarily in Ontario . Qualifying expenditures are listed in Section 95 (16) Taxation Act, 2007. See OBPTC Guidelines. D: Digital transfer costs incurred outside Ontario

- Total expenditures incurred outside Ontario that reasonably relate to transferring a prepared digital or electronic version of the literary work into or onto a form suitable for distribution. E: Marketing/Promotional costs - Qualifying expenditures incurred within the period that begins 12 months before and ends 12 months after the date of publication of the literary work, including: F: Total estimated eligible expenditures - A Ontario + B Ontario + C Ontario [x50%] + D Ontario [x50%] + E Ontario + E Non-Ontario = F Total of estimated eligible expenditures. G: Government assistance (title specific) - Government assistance means assistance from a government, municipality, or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax, and investment allowance, but excluding an Ontario Book Publishing tax credit, an Ontario Innovation tax credit, or a grant that is not specific to a particular eligible literary work. For example, amounts received from the Department of Canadian Heritage’s Canada Book Fund, as well as Block Grants from the Canada Council for the Arts and the Ontario Arts Council, would not be considered government assistance, as none of these are title-specific. H: Total eligible expenditures (F-G) - H Total estimated eligible expenditures less any government assistance. Filling out the Administration Fee Section: Fill in all the applicable

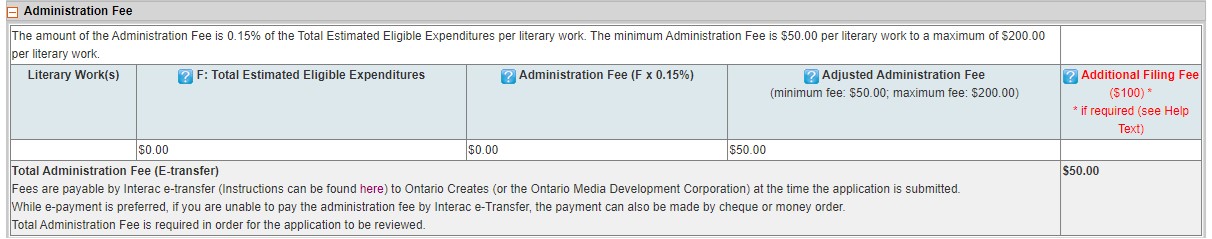

information as shown below. Definitions for the Administration Fee Section: Total

Eligible Expenditures - Total estimated eligible expenditures less

any government assistance. Administration fee (F x 0.15%)

- The Administration Fee is non-refundable. Adjusted

Administration Fee (minimum fee: $50; maximum fee: $200) - See

OBPTC Guidelines. An additional filing fee of $100.00 will be applied to OBPTC Applications for Certificates of Eligibility received more than 24 months after the year-end of the claim. This additional filing fee is automatically calculated, and the $100.00 will be added to the Total Administration Fee only when required. Supporting Documents: Definitions for Supporting Documents: Administration fee - Calculated per title. Copy of the Book in Digital Format must be submitted with the application.

Applicant Declaration - Please ensure

the document is signed and dated by a signing officer (director and/or officer) of the corporation. Incorporation Documents for

the Qualifying Corporation - Submit

(in its entirety) all applicable incorporation documents, including Certificate and Articles

of Incorporation, Articles of Amendment, Articles of Amalgamation, etc.

All Applicable Financial

Statement(s) for Qualifying Book Publisher - Financial

Statements for all applicable taxation years. List of Applicant Company's

Shareholders or Corporate Chart for Applicable taxation year A Copy of Previous Year's

Catalogue(s) - Submit a digital copy of the catalogue(s). A Copy of Current Year's

Catalogue(s) - Submit a digital copy of the catalogue(s). A Copy of Company's Distribution

Agreement Proof of Citizenship and Residency for Author(s) - Provide a signed Declaration of Citizenship & Residency for each author. Contract with Publisher for

Author(s) - Provide contract(s) with

all authors to publish the current literary work. For anthologies you

can provide contract with the editor. Copy of Printer's Invoice

- Required for each book, unless it was published after December 31, 2019 in a digital format only. Once you have completed all sections of the Tax

Credit Application, click the

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button. Additional fields will display. To remove

a row, simply click the Remove

link.

button. Additional fields will display. To remove

a row, simply click the Remove

link. icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

button.

button.

• salaries or wages paid to employees involved in editing, design and project management,

• fees for freelance editing, design and research, and

• amounts in respect of the cost of art work, developing prototypes, set-up and typesetting

(See OBPTC Guidelines and Section 95 (16) of the Taxation Act, 2007)

These cost include amounts for the following activities if they were carried out primarily in Ontario:

• salaries or wages paid to employees involved in editing, design and project management,

• fees for freelance editing, design and research, and

• amounts in respect of the cost of art work, developing prototypes, and set-up

• salaries, wages, fees or other amounts for related activities, including scanning, editing, formatting, indexing, encryption and establishing digital rights management or other technological protection measures.

(See OBPTC Guidelines and Section 95 (16) of the Taxation Act, 2007)

• expenditures for promotional tours by the eligible Canadian author(s), except that only 50% of expenditures for meals and entertainment are qualifying expenditures,

• salaries or wages paid to employees of the company engaged in marketing copies of the published literary work, and

• amounts expended in respect of promoting and marketing copies of the published literary work.

(See OBPTC Guidelines and Section 95 (16) of the Taxation Act, 2007)

button to submit

your application to Ontario Creates.

button to submit

your application to Ontario Creates.