Click on the  link.

link.

Create OPSTC Tax Credit Application

Please Note:

Applications will only enter the queue to be reviewed on a first come, first served basis once all required information and documentation has been entered and uploaded.

Applications can be made for prior taxation years as long as that taxation year is not statute barred. To determine statute barred status, the applicant can contact Canada Revenue Agency (CRA). If not statue barred, the applicant can amend a previously filed tax return with CRA, with the amount of the OPSTC certificate entered. It is the applicant’s responsibility to ensure that they are not statute barred from amending a tax return for a previous taxation year.

Please consult the CRA website for more information on statute barred dates or contact the Toronto Film Services Unit at (416) 973-3407 or (416) 954-0542.

Create an OPSTC Tax Credit Application:

Click on the  link.

link.

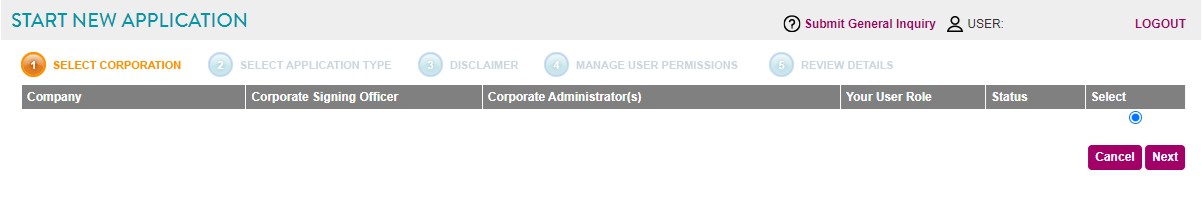

The Applications

page will display as shown below.

Using the radial check

boxes under the Select column,

select your desired Company and

click  . The following page will display.

. The following page will display.

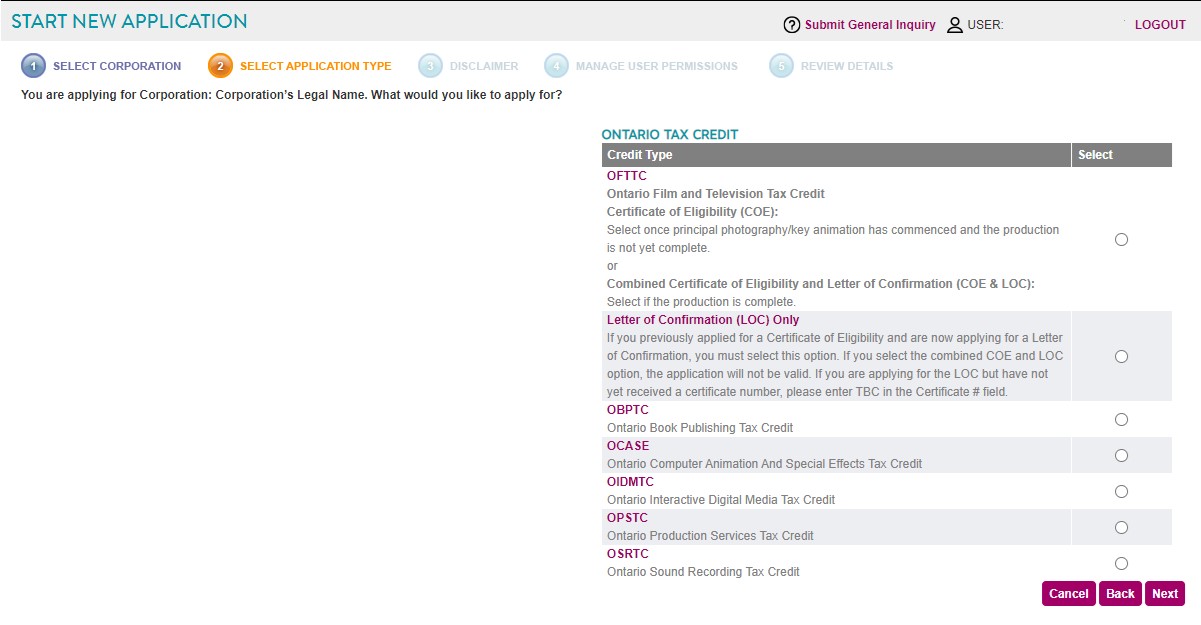

Under the Select

column, select OPSTC and click

.

.

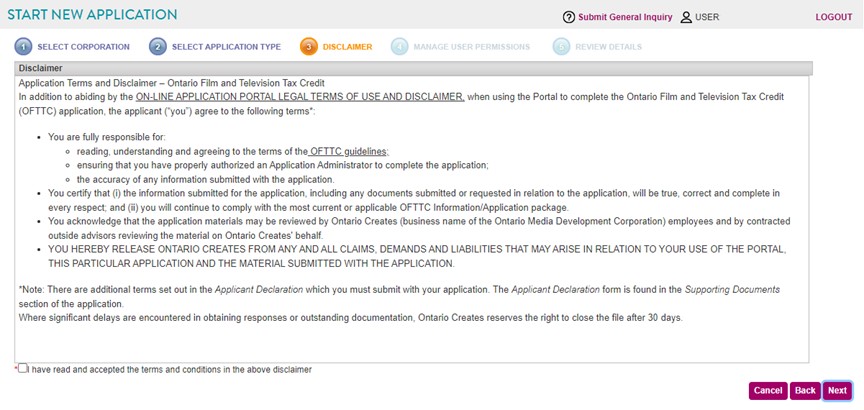

The Disclaimer page will display.

Check the "

I have read and accepted the terms and conditions

for the above disclaimer

" radial box and click  .

.

The Manage Users Permission page will display.

Using the Application

check boxes, select the User Permission

and click  . The

Review

Details

page will display as shown below to ensure the information

you have entered is correct.

. The

Review

Details

page will display as shown below to ensure the information

you have entered is correct.

Click  .

.

Filling out the General, Production Details Production Schedule Information, Calculation of OPSTC Estimate, Administration Fee and Supporting Documents Sections:

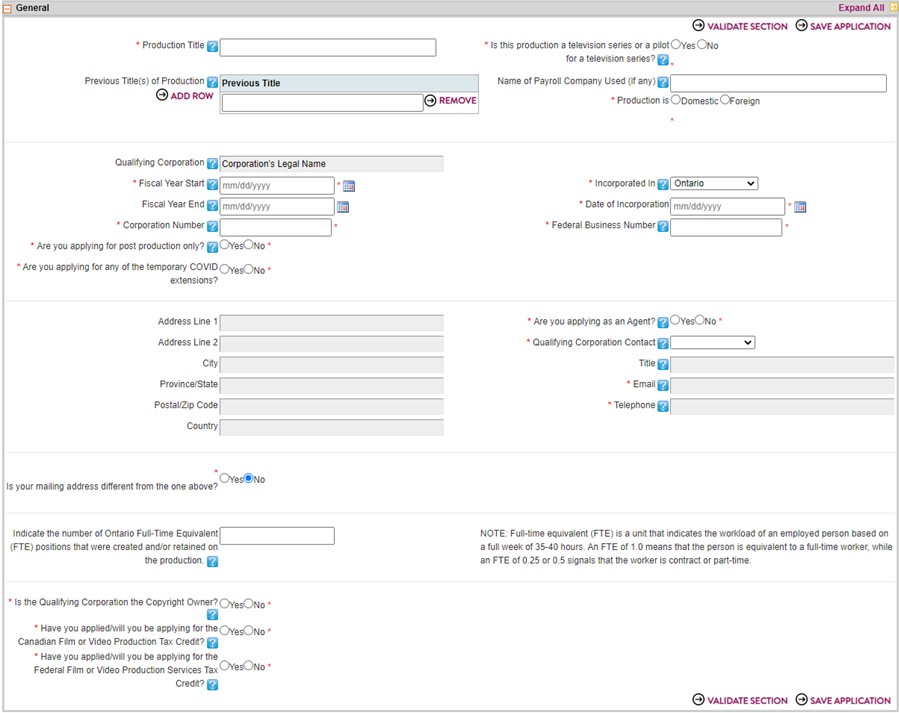

Filling out the General section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Add a Row:

To add a row under, click

the  button. Additional fields will display. To remove

a row, simply click the Remove

link.

button. Additional fields will display. To remove

a row, simply click the Remove

link.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validate that content is correctly/incorrectly filled in.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the General Section:

Production Title - Enter the name of the production.

Is this production a television series? - A television series consists of more than one episode.

Cycle - Select the season number from the dropdown menu. Enter the episode numbers for the season.

Previous Title(s) of Production - Please list any previous working title(s) for this production.

Name of Payroll Company Used (if any) - Enter payroll company name or internal if done in-house.

Applicant Organization/Qualifying Corporation - This is the corporation’s legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Taxation Year End - Enter the end of your company’s taxation year for the current application. If you have not filed a corporate tax return yet, please enter the anticipated year end date.

Corporation Number - This is the number on the Articles of Incorporation.

Federal Business Number - This is the nine digit account number that CRA assigned to the applicant corporation.

Incorporated In - This is the jurisdiction where the company is incorporated.

Are you applying for any of the temporary COVID extension?

New Temporary Rule Criteria to Qualify for the Extension CRA Waiver and Ontario Creates Waiver & COVID Statement Requirements

Extend the timeline to meet the minimum spending requirements from within 24 months to within 48 months after principal photography/key animation (“PP”) began.

a) The production incurred an expenditure in a taxation year ending in 2020 and 2021; and

b) The expenditure would have been an eligible wage expenditure, an eligible service contract expenditure or an eligible tangible property expenditure if PP for the production had commenced in the year the expenditure was incurred.

• File a valid, completed waiver with the CRA for the taxation year in which PP began; and

• Include a completed Ontario Creates Waiver & COVID Statement for that taxation year with your application for a Certificate of Eligibility.

Allow productions to claim otherwise eligible expenditures incurred from only the year in which PP began to the two taxation years prior to the year in which PP began.

a) The production incurred an expenditure in a taxation year ending in 2020 and 2021;

b) The expenditure would have been an eligible wage expenditure, an eligible service contract expenditure or an eligible tangible property expenditure if PP for the production had commenced in the year the expenditure was incurred; and

c) The production commenced PP on or after March 15, 2020.

No CRA waivers are required, but you must indicate that you are seeking this extension by completing the Ontario Creates Waiver & COVID Statement.

The temporary extensions and applicable criteria are summarized in this table:

Ontario Creates Waiver Declaration & Statement of Intent to Claim COVID-19 Extensions (“Ontario Creates Waiver & COVID Statement”) – The form must be signed by an officer and/or director of the corporation.

In order to extend the timeline to meet the minimum spending requirements, the corporation must file a valid, completed Waiver in Respect of the Normal Reassessment Period (Form T2029) with the CRA for the taxation year in which principal photography began, if their income tax return has been assessed for that year. The completed CRA waiver should be sent to one of three CRA tax centers (mailing addresses are available here). The corporation must also include a completed Ontario Creates Waiver Declaration & Statement of Intent to Claim COVID-19 Extensions (“Ontario Creates Waiver & COVID Statement”) for that taxation year in their application for a Certificate of Eligibility. If the corporation’s income tax return for the relevant taxation year has not yet been assessed, a valid form T2029 Waiver cannot be filed with the CRA for that year. However, the corporation can still obtain this extension by filing a completed Ontario Creates Waiver & COVID Statement. To request the extension, please complete page 2 of the form.

Minimum Production Expenditures

The total expenditures included in the cost of the production during the 24 months after principal photography began must exceed the minimum expenditures set out below. The aforementioned 24 month period is extended to 48 months if the production qualifies for the extension:

i. $1 Million, if the production is not a television series or a pilot episode for a television series,

OR

ii. If the production is a television series, or a pilot for a television series:

• $100,000 if the episode has a running time that is less than 30 minutes, or

• $200,000 in any other case.

Are you applying as an Agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicant’s consent.

Contact - Please select the primary contact from the dropdown list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contact’s title. It can be changed in the User Profile.

Email - This is the contact’s email. It can be changed in the User Profile.

Telephone - This is the contact’s telephone. It can be changed in the User Profile.

Indicate the number of Ontario Full-Time Equivalent (FTE) positions

-

The provincial government has requested that Ontario Creates collect this data to understand the impact of support to these sectors.

An FTE is defined as a work week of approximately 35-40 weeks over the life of the project. For example:

• If an individual was engaged on the project for about 20 hours a week, they would be considered 0.5 (or half) an FTE.

• If an individual worked 35-40 hours a week but only worked for half of the production length, then they would also be a half an FTE.

Corporate Group or Parent Company - If the applicant corporation is controlled or owned by a corporate group or parent company, enter the name here.

Is the Qualifying Corporation the Copyright Owner? - Enter ‘yes’ only if Copyright is held by Qualifying Corporation.

Is the Qualifying Corporation Canadian Owned and Controlled? - A company is Canadian Owned and Controlled if 51% is owned by a Canadian.

Have you applied/will you be applying for the Canadian Film or Video Production Tax Credit? - This question refers to CAVCO’s Canadian Content tax credit.

Have you applied/will you be applying for the Federal Film or Video Production Services Tax Credit? - This question refers to CAVCO’s Production Services tax credit.

Copyright Owners - List all Copyright Owners in the production.

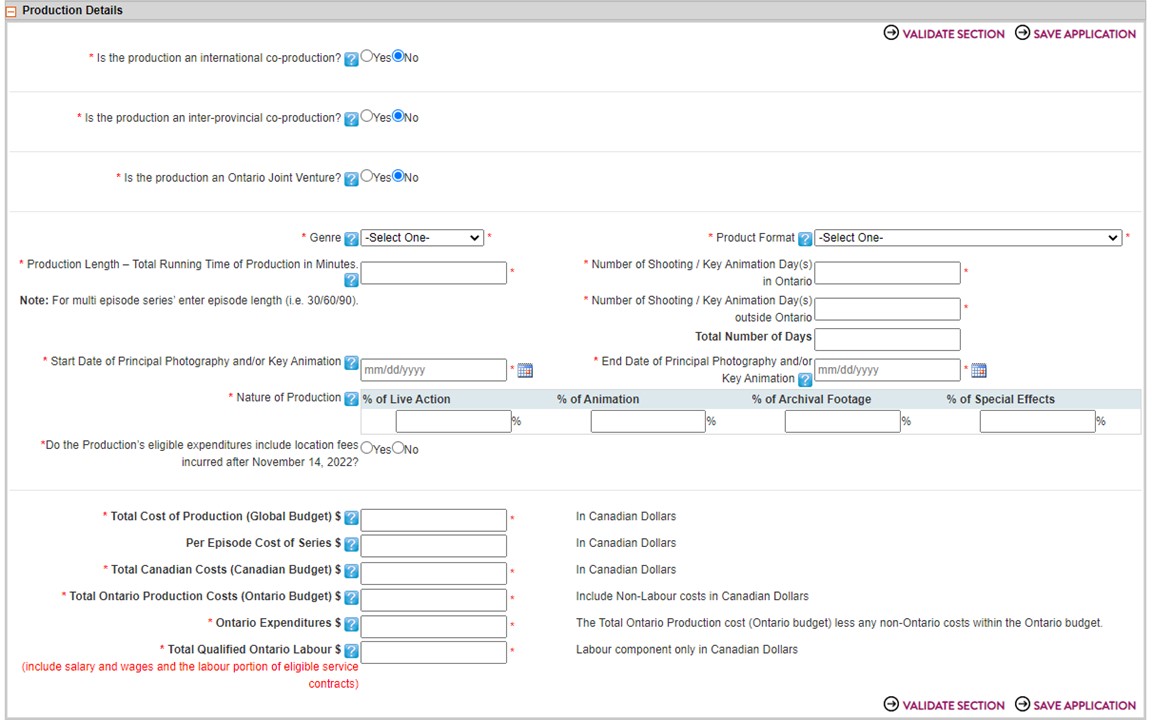

Filling out the Production Details Section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the Production Details Section:

Is the production an international treaty co-production? - An international treaty co-production is a film or television production that is jointly produced between a Canadian-controlled production company and a foreign coproduction company in accordance with an audiovisual coproduction treaty between the partnering countries. Treaty co-productions are administered by Telefilm Canada on behalf of the Department of Canadian Heritage.

Is the production an inter-provincial co-production? - An “inter-provincial co-production” is a film or television production that is jointly produced in accordance with a co-production agreement between one or more Ontario production companies and one or more Canadian companies based in another province.

Is the production an Ontario joint venture? - This is a production between 2 or more Canadian Ontario-based companies that jointly own the copyright in the production, and where each company incurs production expenses and claims the tax credit. Where these companies incorporate a subsidiary company that is the sole copyright owner of the production, it is not considered an Ontario joint venture.

Production length Total Running Time in Minutes

Start date of principal photography and/or key animation

End date of principal photography and/or key animation

Total Cost of Production (Global Budget) $ - This is the total of Canadian and international costs.

Per episode cost of series This is based on the total cost of production.

Total Canadian Costs (Canadian Budget) $ - This is the consolidated cost from all Canadian jurisdictions.

Ontario Expenditures $ - The Total Ontario Production cost (Ontario budget) less any non-Ontario costs within the Ontario budget.

Total Ontario Production Costs (Ontario Budget) $ - This is the Ontario Producer’s costs (both Ontario and non-Ontario expenditures).

Total Qualified Ontario Labour $ - - The qualifying Ontario labour amount must represent at least 25% of the total qualifying production expenditure. This amount consists of the production company’s eligible salary and wages and the labour portion of the company's eligible service contract expenditures, which includes payments to freelance contractors who are not employees of the production company. If the amount of salary or wages paid by the service provider to its Ontario based employees is not available, the CRA will accept as an administrative practice, 65% of the labour portion of the invoice amount as a reasonable estimate of the salary or wages paid to the employees. When non-labour amounts (such as rental fees, goods provided by the service provider, and travel and living expenses) are included in a payment to a service provider, but there is no breakdown on the invoice, estimate the labour part of the invoice before applying the 65% rate. Note that the 65% administrative position does not prevent the CRA from auditing a third party to determine the actual amounts paid to employees. Qualifying production expenditures will be capped at 4 times the total eligible Ontario labour amount.

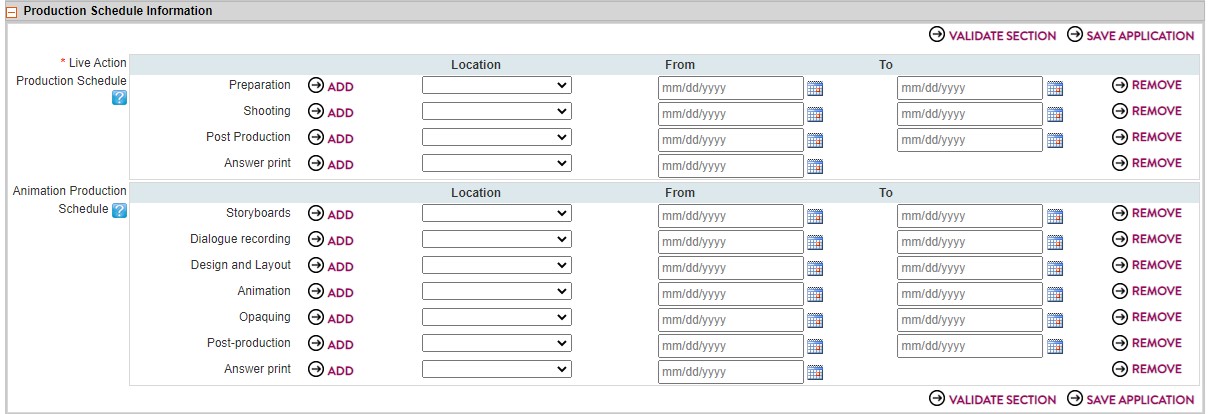

Filling out the Production Schedule Information Section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys to scroll through the months or click directly on a day to populate that day.

Add a Row:

To add a row under, click

the  button. Additional fields will display. To remove

a row, simply click the

button. Additional fields will display. To remove

a row, simply click the  link.

link.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the Production Schedule Information Section:

Live action production schedule

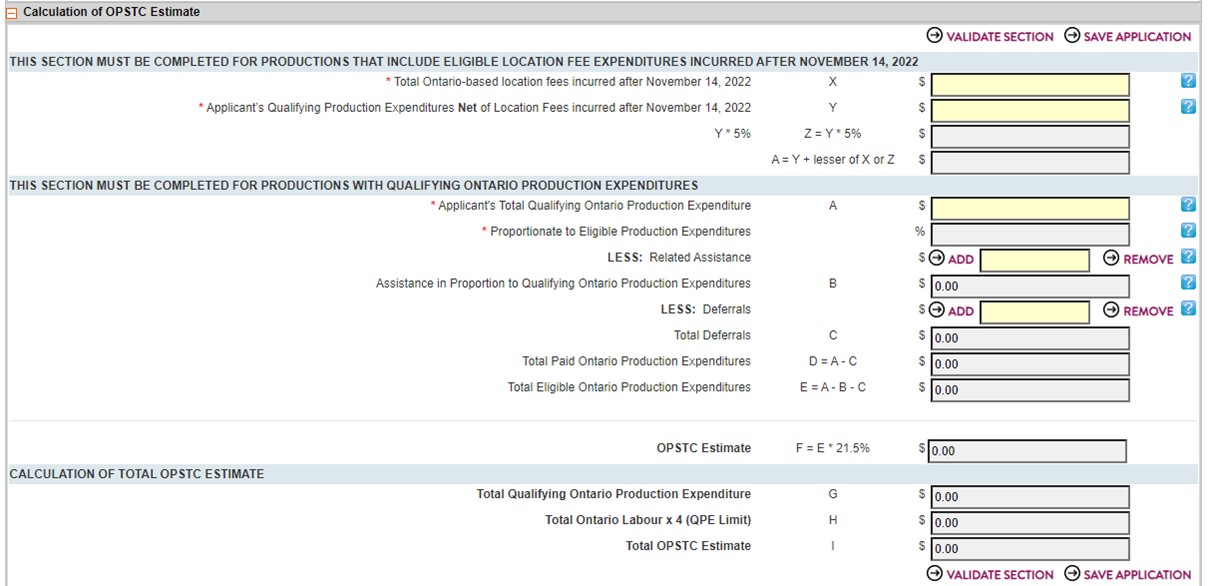

Filling out the Calculation of OPSTC Estimate Section:

Fill in all the applicable information as shown below.

Add a Row:

To add a row under, click

the  button. Additional fields will display. To remove

a row, simply click the

button. Additional fields will display. To remove

a row, simply click the  link.

link.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the Calculation of OPSTC Estimate Section:

*Applicant’s Total Qualifying Ontario Production Expenditures - Qualifying production expenditures consist of eligible wages, eligible service contracts and eligible tangible property expenditures.

*Total Ontario-based location fees incurred after November 14, 2022 - In the case of expenditures incurred after November 14, 2022, in respect of real property leased by the corporation from a person or partnership that is not ordinarily engaged in the business of leasing the type of real property in question, the expenditures must be paid to a person or partnership that deals at arm’s length with the corporation, in the case of an individual who is not an employee of the corporation, and in the case of a partnership whose members are not employees of the corporation; and the maximum eligible expenditures for leasing real property for on-location filming that can be claimed is 5% of the production’s qualifying production expenditures, net of these location costs.

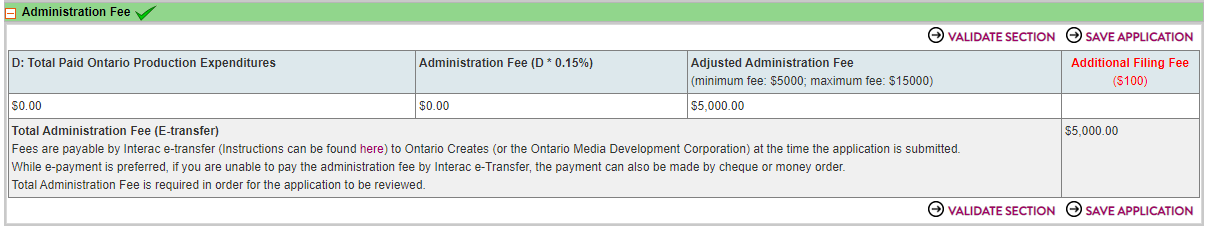

Administration Fee Section:

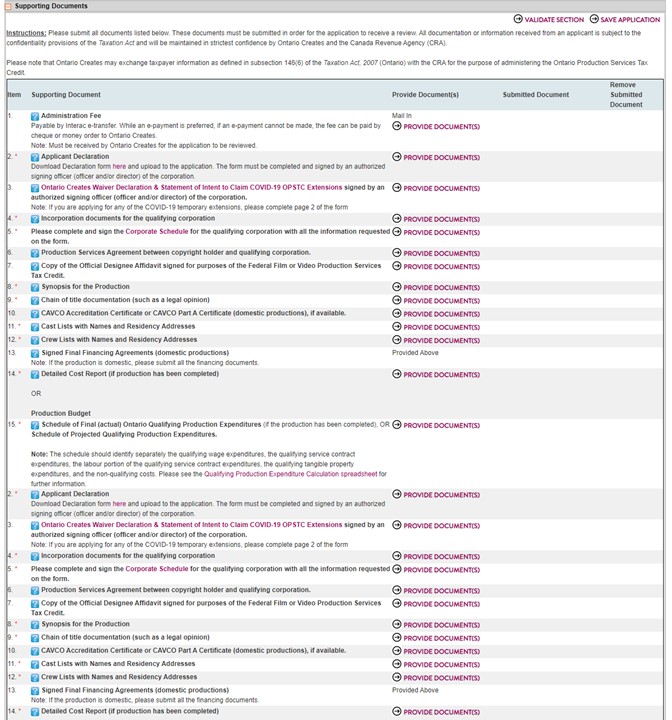

Supporting Documents:

Definitions for Supporting Documents:

Administration Fee - % The OPSTC administration fee is calculated as 0.15% of the eligible expenditures for the application. There is a minimum fee of $5,000 and a maximum fee of $10,000 per application. The total Administration Fee is required in order for the application to be reviewed. The Administration Fee is non-refundable.

The maximum fee will increase from $10,000 to $15,000 for applications received on and after May 1, 2023. The base rate will remain the same at 0.15% of eligible expenditures.

Note that there are additional fees of:

- $100 for Amended Certificates, and

- $100 for applications that are submitted more than 24 months from the company’s relevant year-end.

Applicant Declaration - The declaration must signed by an officer and/or director of the qualifying corporation.

Incorporation documents for the qualifying corporation

Corporate Schedule - Please complete and sign the Corporate Schedule for the qualifying corporation with all the information requested on the form, including the names and citizenship of the shareholder(s) with percentage of voting shares held; and names and citizenship of the officers and directors of the qualifying corporation.

Production Services Agreement - Required if Qualifying Corporation is not Copyright Holder.

Copy of the Official Designee Affidavit signed for purposes of the Federal Film or Video Production Services Tax Credit, if applicable - Required if Qualifying Corporation is not Copyright Holder.

Chain of title documentation (such as a legal opinion)

CAVCO Accreditation Certificate or CAVCO Part A Certificate, if available

Detailed Cost Report (if production has been completed) OR Production Budget

Signed Final Financing Agreements - The agreements are required if the production is domestic.

Schedule of Final (actual) Ontario Production Expenditures(if the production has been completed) OR Schedule of Projected Production Expenditures.

Note The schedule should identify separately the qualifying wage expenditures, qualifying service contract expenditures, the labour portion of the qualifying service contract expenditures, the qualifying tangible property expenditures, and the non-qualifying costs. Please see the Qualifying Production Expenditure Calculation spreadsheet for further information (link provided in the supporting documents section).

Other Documents - All other supporting documents that are not listed in the document items above can be uploaded here.

Once you have completed all sections of the

Tax

Credit Application

, click the  button to submit

your application to Ontario Creates.

button to submit

your application to Ontario Creates.