Click on the ![]() link.

link.

Create OIDMTC Tax Credit Application

Please Note:

Applications will only enter the queue to be reviewed on a first come, first served basis.

In an effort to streamline our tax credit administration process, please note that starting April 1, 2011, the OMDC is implementing a mandatory policy that all OMDC tax credit applications must be submitted via our Online Application Portal and all requested documents must be uploaded through the OMDC portal.

A red Asterix * beside a field in the application form, or beside checklist items for requested documents indicates that those items are mandatory and must be completed or those specific documents must be attached in order to proceed with the application.

The March 26 2009 Budget Proposed OIDMTC enhancements related to OIDMTC rates and digital game development are included in this form.

Only 1 application per fiscal year can be filed. For applications that include specified and non-specified products applications must contain all products completed in that fiscal year. For example, for a July 31 2008 fiscal year end, an interactive digital media product completed on February 2 2008 would be submitted in a 2008 fiscal year OIDMTC claim, whilst a product completed on July 1 2009 would be submitted in a 2009 fiscal year OIDMTC claim.

For qualifying digital game corporations making an OIDMTC claim under section (93.1) the application can be made to OMDC after the end of the 36-month period in which the applicant has incurred a minimum of $1 million in Ontario labour expenditures in respect of an eligible digital game.

For specialized digital game corporations making an OIDMTC claim under section (93.2) the application can be made to the OMDC at the end of the taxation year in which the applicant has incurred a minimum of $1 million of Ontario labour expenditures in respect of eligible digital game activities that are directly attributable to the development of eligible digital games.

Applications can be made for prior fiscal years as long as that fiscal year is not statute barred. To determine statute barred status, the applicant can contact Canada Revenue Agency (CRA). If not statute barred, the applicant can amend a previously filed tax return with CRA, with the amount of the OIDMTC certificate entered. It is the applicant’s responsibility to ensure that they are not statute barred from amending a tax return for a previous fiscal year.

Please consult the CRA website for more information on statute barred, http://www.cra-arc.gc.ca/E/pub/tp/ic07-1/ic07-1-e.html#P261_36138, or at 416 973 3407.

Create an OIDMTC Tax Credit Application:

Click on the ![]() link.

link.

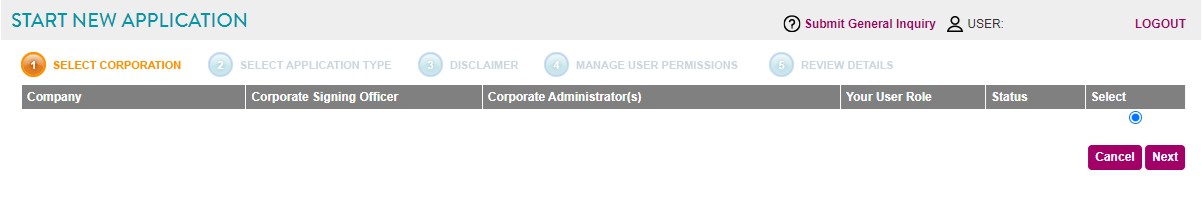

The Applications

page will display as shown below.

Using the radial check

boxes under the Select

column, select your desired Company

and click  . The following page will display.

. The following page will display.

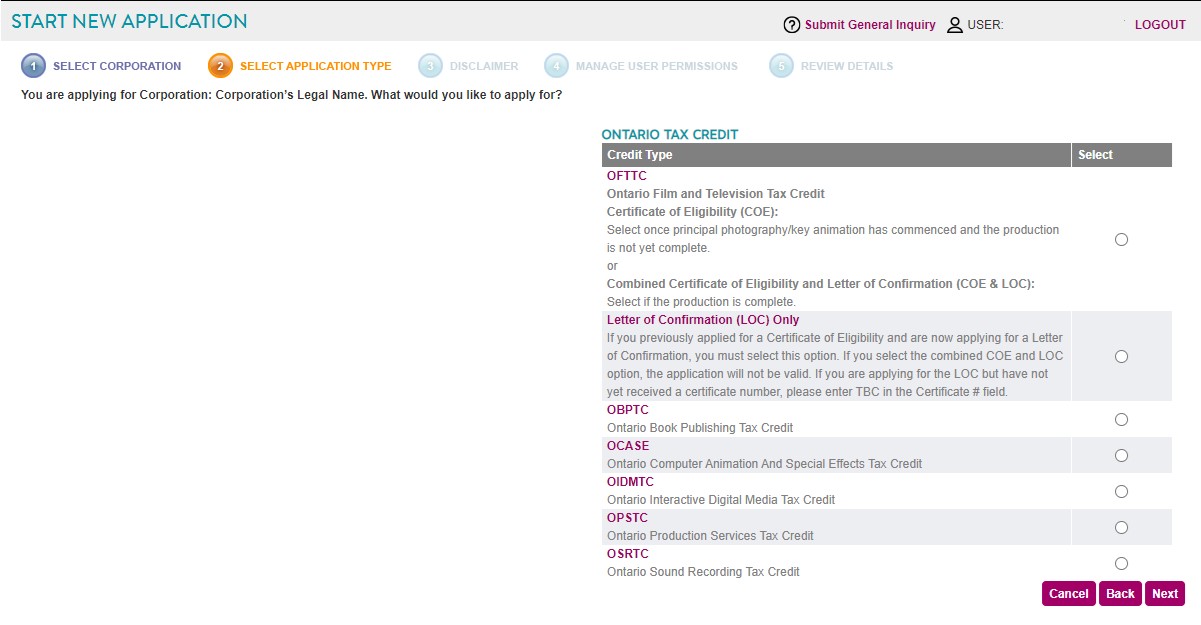

Under the Ontario

Tax Credit column, select OIDMTC

and click  .

.

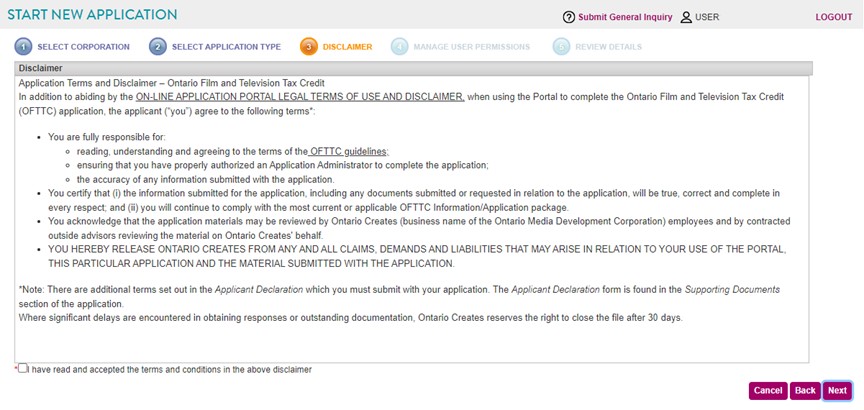

The Disclaimer page will display.

Check the "I have read and accepted the terms and

conditions for the above disclaimer" radial box and click

.

.

The Manage Users Permission page will display.

Using the Application

check boxes, select the User Permission

and click  . The Review

Details page will display as shown below to ensure the information

you have entered is correct.

. The Review

Details page will display as shown below to ensure the information

you have entered is correct.

Click  .

.

Filling out the General, Product Details, Calculation of Ontario Product Expenditures for Specified Products, Calculation of Ontario Product Expenditures for Non-Specified Products, Calculation of Ontario Labour Expenditures for Qualifying Digital Game Corporations (93.1), Calculation of Ontario Labour Expenditures for Specialized Digital Game Corporations (93.2), Calculation of OIDMTC Estimate, Administration Fee and Supporting Documents Sections:

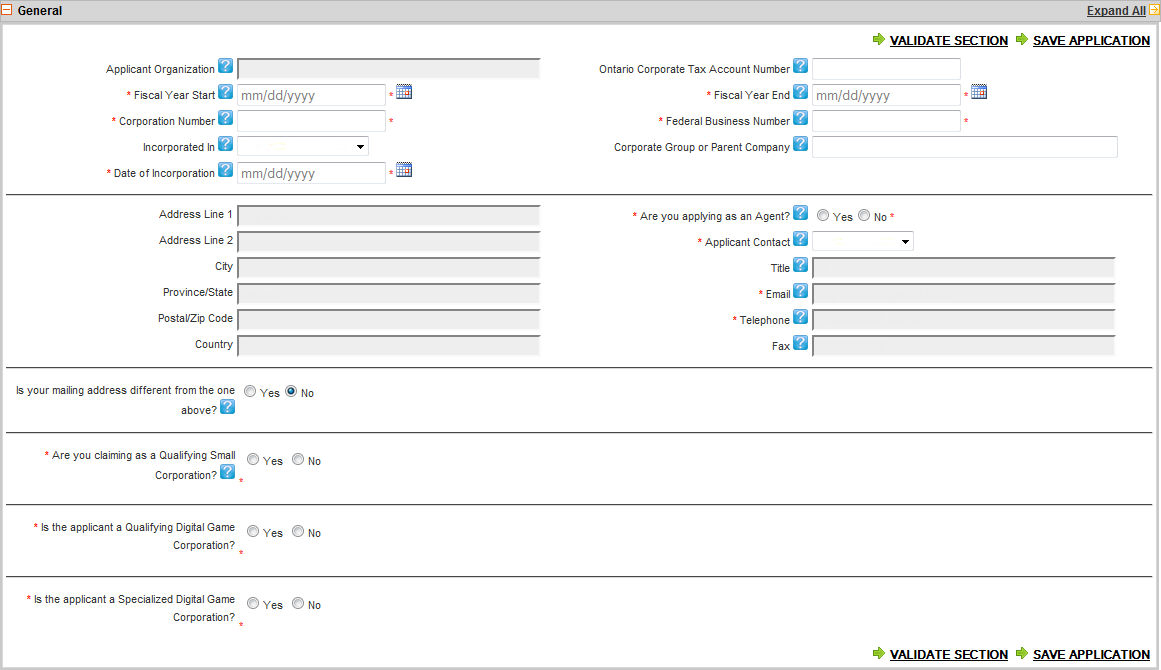

Filling out the General section:

Fill in all the applicable information as shown below.

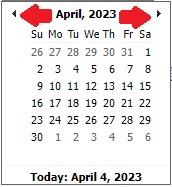

To use the Calendar

function, click on the ![]() icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Applications button as often as you need.

After you have filled in

a section on ANY Tax Credit

Form, click the  button to ensure you have filled that

portion of the form out correctly. If the validation is okay, the header

will change to green.

button to ensure you have filled that

portion of the form out correctly. If the validation is okay, the header

will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validated the content is correctly/incorrectly filled in.

If you are unclear about

a certain field, click the ![]() icon, this will take you to the

specific section of the Online Help File where a definition for that field

will display.

icon, this will take you to the

specific section of the Online Help File where a definition for that field

will display.

Definitions for the General Section:

Applicant Organization/Qualifying Corporation - This is the corporation’s legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Ontario Corporate Tax Account Number - The Ontario Corporate Tax Account Number is issued by the Province for companies filing tax returns for fiscal years ending before January 1, 2009. This number is being replaced by the Federal Business Number for fiscal years ending in 2009 and beyond.

Fiscal Year Start - Enter the start of your company’s fiscal year for the current application.

Fiscal Year End - Enter the end of your company’s fiscal year for the current application.

Enter the end of your company’s fiscal year for the current application. If you have not filed a corporate tax return yet, please enter the anticipated year end date.

You cannot submit an online form for a fiscal year end prior to March 24, 2006 as the OIDMTC tax credit was calculated differently at that time. Please contact OMDC for further information.

Corporation Number - The Corporation Number is different from the Ontario Corporate Tax Account Number. This is the number on the Articles of Incorporation.

Federal Business Number - The Federal Business Number is replacing the Ontario Corporate Tax Account Number for fiscal years ending in 2009 and beyond.

Incorporated In - This is the jurisdiction where the company is incorporated.

Corporate Group or Parent Company - If the applicant corporation is controlled or owned by a parent company or corporate group, enter that name here.

Are you applying as an Agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicant’s consent.

Contact - Please select the primary contact from the dropdown list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contact’s title. It can be changed in the User Profile.

Email - This is the contact’s email. It can be changed in the User Profile.

Telephone - This is the contact’s telephone. It can be changed in the User Profile.

Fax - This is the contact’s fax. It can be changed in the User Profile.

Indicate the number of Ontario Full-Time Equivalent (FTE) positions - The Ministry of Tourism, Culture and Sport has requested that OMDC collect this data to understand the impact of support to these sectors. An FTE is defined as a work week of approximately 35-40 weeks over the life of the project. For example:

Is your mailing address different from the one above? - If your mailing address is different from the address in the General section, enter your mailing address here.

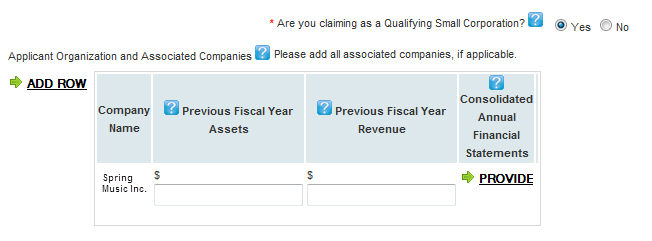

Are you claiming as a Qualifying Small Corporation? - A Qualifying Small Corporation is a corporation that had during the current taxation year (tax year of application) neither annual gross revenues in excess of $20 million nor total assets in excess of $10 million, and if the corporation is associated with one or more corporations the sum of total assets of the corporation during the current taxation year and for each associated corporation’s preceding taxation year had neither annual gross revenues in excess of $20 million nor total assets in excess of $10 million. See the Taxation Act, S.O. 2007, Section 93(14).

Please note: If applicant is making an OIDMTC application for a taxation year prior to 2009, we would need to review the applicant corporation’s and any associated corporation’s gross revenues and total assets for the preceding taxation year only.

Applicant Organization and Associated Companies - Associated Corporations are defined in subsection 256(1) of the Income Tax Act (Canada), reproduced in Appendix 6-V of the OIDMTC Guideline.

Current Fiscal Year Assets – Enter the value of the assets of the applicant corporation for the current fiscal year (fiscal year of tax credit application).

Current Fiscal Year Revenue – Enter the value of the revenue of the applicant corporation for the current fiscal year (fiscal year of tax credit application).

Previous Fiscal Year Assets - For OIDMTC applications for a taxation year prior to 2009, enter the value of the assets of the applicant and all associated companies for the fiscal year that ends prior to the year of this tax credit application. For OIDMTC applications for a taxation year after 2008, enter the value of the assets of all associated companies for the fiscal year the ends prior to the year of this tax credit application.

Previous Fiscal Year Revenue - For OIDMTC applications for a taxation year prior to 2009, enter the value of the revenue of the applicant and all associated companies for the fiscal year that ends prior to the year of this tax credit application. For OIDMTC applications for a taxation year after 2008, enter the value of the revenue of all associated companies for the fiscal year that ends prior to the year of this tax credit application.

Is the applicant a Qualifying Digital Game Corporation? - a Qualifying Digital Game Corporation is a Canadian corporation that carries on through a permanent establishment in Ontario a business that includes the development of digital games, and has incurred not less than $1million in qualifying Ontario labour expenditures within any 36 month period ending in the taxation year, for an eligible digital game that is developed in whole or in part by the qualifying digital game corporation under the terms of an agreement between the qualifying digital game corporation and a purchaser that is a corporation.

Is the applicant a Specialized Digital Game Corporation? - a Specialized Digital Game Corporation is a Canadian corporation that carries on through a permanent establishment in Ontario a business that includes the development of digital games and must also demonstrate the following:

(Either A or B must be satisfied)

A) Total salaries and wages incurred by the corporation in the taxation year for services rendered in Ontario that are directly attributable to the development of digital games are not less than 80% of the total of salaries and wages incurred by the corporation in the taxation year for services rendered in Ontario, OR

B) The corporation’s gross revenue for the year that is directly attributable to the development of digital games is not less than 90% of the corporation’s total gross revenue for the year,

AND

C) Total Ontario Labour Expenditures in respect of eligible digital games for the taxation year cannot be less than $1 million.

Please note: A Specialized Digital Game Corporation may apply to the OIDMTC with an annual claim for Ontario labour expenditures incurred in the taxation year in respect of eligible digital games.

Consolidated

Annual Financial Statements ![]() - Upload

the previous year’s financial statements for each associated company.

- Upload

the previous year’s financial statements for each associated company.

Is the applicant a Qualifying Digital Game Corporation? - a Qualifying Digital Game Corporation is a Canadian corporation that carries on through a permanent establishment in Ontario a business that includes the development of digital games, and has incurred not less than $1million in qualifying Ontario labour expenditures within any 36 month period ending in the taxation year, for an eligible digital game that is developed in whole or in part by the qualifying digital game corporation under the terms of an agreement between the qualifying digital game corporation and a purchaser that is a corporation.

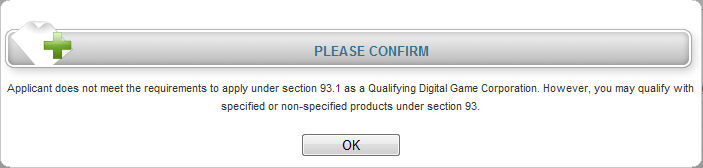

The applicant corporation has incurred a minimum of $1million in Ontario labour costs incurred in any 36-month period, in Ontario that are directly attributable to the development of a digital game that is developed in whole or in part by the applicant corporation under the terms of an agreement with a purchaser corporation? -

Note: This question only displays when the previous question is answered with a "Yes"

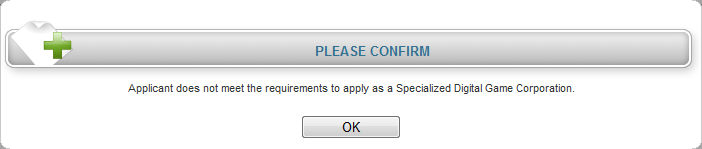

If the answer to this question is "No" the following message will display and the previous question's answer is switched to No.

Is the applicant a Specialized Digital Game Corporation? -

The applicant corporation has a minimum of $1million in Ontario labour costs incurred in Ontario in the tax year that are directly attributable to the development of eligible digital games? -

Note: This question only displays when the previous question is answered with a "Yes"

If the answer to this question is "Yes" the following table will display.

Note: The two percentages must add up to 100%

If the answer to this question is "No" the following message will display and the previous question's answer is switched to No.

Applicant Organization and Associated Companies - Associated Corporations are defined in subsection 256(1) of the Income Tax Act (Canada), reproduced in Appendix 6-V of the OIDMTC Guideline.

CALCULATION OF ONTARIO PRODUCT

EXPENDITURES FOR ELIGIBLE PRODUCTS ![]() - If

the applicant not a Qualifying Small Corporation and the product start

date is prior to March 24, 2006, all textboxes within the "Prior

to March 24 2006" period for that product are disabled, except for

column A (Total Production Costs), which the applicant must fill in. See

the Taxation Act, S.O. 2007, Section 93(3).

- If

the applicant not a Qualifying Small Corporation and the product start

date is prior to March 24, 2006, all textboxes within the "Prior

to March 24 2006" period for that product are disabled, except for

column A (Total Production Costs), which the applicant must fill in. See

the Taxation Act, S.O. 2007, Section 93(3).

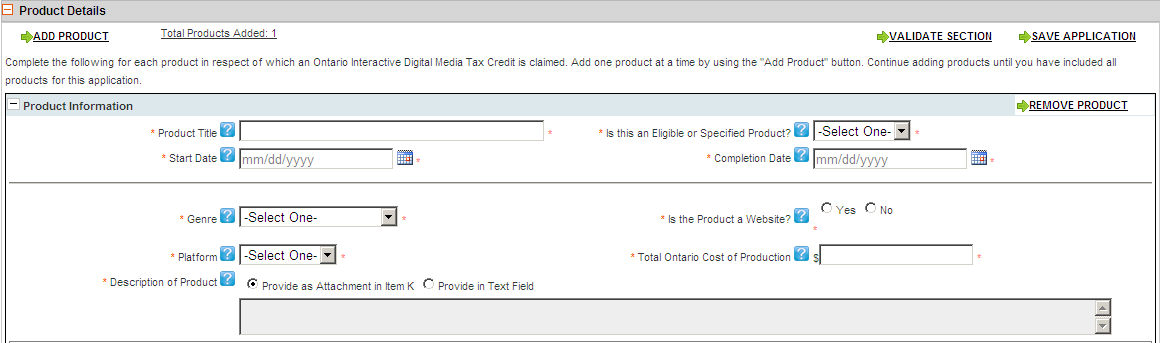

Filling out the Product Details Section:

Fill in all the applicable information as shown below.

To Save

and Add a Product,

click the ![]() button. To Remove

a Product, simply click

the

button. To Remove

a Product, simply click

the ![]() button.

button.

Note: You may click the Save Application button as often as you need.

If you are unclear about

a certain field, click the ![]() icon, this will take you to the

specific section of the Online Help File where a definition for that field

will display.

icon, this will take you to the

specific section of the Online Help File where a definition for that field

will display.

Definitions for the Product Details Section:

Product Title - For products that have or may have multiple versions, please add a version number, for example v2.0. For websites, add the fiscal year as a suffix, for instance (2008). The product title indicated on the application must be the title of the product as it was or will be when commercially exploited or released.

Product Type- There are five options to choose from in the dropdown menu: Digital Game (93.1), Digital Game (93.2), Non-Specified (93), Non-Specified (93) M&D Only, or Specified (93)

Non-Specified (93): A non-specified product is an interactive digital media product and all or substantially all (90%) of the product was developed in Ontario by the qualifying corporation for sale or licensing by the qualifying corporation to one or more persons dealing at arm’s length with the qualifying corporation who have not previously entered into an arrangement with the qualifying corporation for the development of the product. See the Ontario Regulations, Sections 34(1)(2)(3)

Non-Specified (93) M&D only: This should be selected for non-specified products that have been included in a previous OIDMTC application and are now claiming any additional unclaimed marketing and distribution costs for that product that have been incurred after the taxation year end in which the product was previously claimed and no later than 12 months following the completion date of the product. See the Taxation Act, S.O. 2007, Section 93(6).

Specified (93): Specified products are interactive digital media products that are developed under a fee-for-service arrangement under the terms of an agreement between the qualifying corporation and an arm’s length purchaser corporation for the purpose of sale or license by the purchaser to one or more persons who deal at arm’s length with the purchaser. See the Taxation Act, S.O. 2007, Section 93(15).

Digital Game (93.1): An eligible digital game developed in whole or in part by a Qualifying Digital Game Corporation, under the terms of an agreement with a purchaser corporation and the Qualifying Digital Game Corporation must have incurred during any 36-month period a minimum of $1 million in Ontario qualifying labour costs directly attributable to the development of that game. See the Taxation Act, S.O. 2007, Section 93.1 (9).

Digital Game (93.2): An eligible digital game developed in whole or in part by a Specialized Digital Game Corporation for the purpose of sale or license by the Specialized Digital Game Corporation or, if applicable, the purchaser, to one or more persons, each of whom deals at arm’s length with the Specialized Digital Game Corporation and the purchaser. See the Taxation Act, S.O. 2007 Section 93.2 (11).

Start Date - Product development start date.

Please note: Start Date for Digital Game (93.1) refers to the start of the 36-month period in which a Qualifying Digital Game Corporation incurred a minimum of $1million in Ontario labour costs that are directly attributable to a digital game. Start Date for Digital Game (93.2) refers to the start of development activities for an eligible digital game that is developed by a Specialized Digital Game Corporation (can be prior to taxation year start).

Completion Date - Non-Specified and Specified Products must be completed to apply for OIDMTC. If you are applying with a Digital Game (93.1) Completion Date refers to the end of the 36-month period (which ends in the taxation year) for Ontario labour expenditures incurred by a Qualifying Digital Game Corporation that are directly attributable to the development of an eligible digital game. If you are applying with a Digital Game (93.2) Completion Date refers to the end of eligible development activities incurred in the taxation year for an eligible digital game developed in whole or in part by a Specialized Digital Game Corporation.

Total Paid Ontario Labour Costs incurred in taxation year: The total paid Ontario labour costs incurred by a Specialized Digital Game Corporation in the taxation year that is directly attributable to the development of the eligible digital game.

Total Ontario Labour Costs for 36-month period: Total Ontario Labour Costs directly attributable to the development of an eligible digital game incurred by a Qualifying Digital Game Corporation in a 36-month period ending in the taxation year in which application is made for an OIDMTC. The total Ontario labour costs incurred in the 36-month period must not be less than $1million, however, only costs incurred after March 26, 2009 are eligible to be included in the OIDMTC calculation.

Name of Purchaser Corporation: Provide name of the purchaser corporation. An eligible digital game developed by a Qualifying Digital Game Corporation must be developed under the terms of an agreement between the Qualifying Digital Game Corporation and a purchaser that is a corporation. See the Taxation Act, S.O. 2007, Section 93.1 (9).

Genre - Select one of the drop down menu choices.

Primary Purpose - Please note that the primary purpose test has been narrowed for products commencing after April 23, 2015 to those that entertain users or educate children under 12. Eligible products with a primary purpose to inform users or to educate users 12 and above will only receive a tax credit on expenditures incurred prior to April 24, 2015. A product can only have one primary purpose.

Does the product have a revenue generating stream? - Please note that products commencing after April 23, 2015 must have a revenue generating stream. Eligible products that were commenced before that date but don’t have a revenue generating stream will only receive a tax credit on expenditures incurred prior to April 24, 2015.

Is the Product a Website? - Used to determine form display settings.

Platform - Select one of the drop down menu choices.

Description of Product - If the Text Field is too small, paste the text into a document and attach it in Item L below.

Government Assistance - means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. If government assistance is provided to the company for purposes other than developing the eligible product please contact OMDC on how to treat this. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada). IRAP- Industrial Research Assistance Program CETC- Cooperative Education Tax Credit

Government Assistance - means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. If government assistance is provided to the company for purposes other than developing the eligible product please contact OMDC on how to treat this. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada). IRAP- Industrial Research Assistance Program CETC- Cooperative Education Tax Credit

A) Only include salary and wages you have paid to your company employees who are Ontario residents, who performed work in Ontario that is directly attributable to the development of the eligible product incurred in the claim period 37 months from the end of the month in which the product was completed.

B) Only include remuneration incurred in the claim period, 37 months from the end of the month in which the product was completed, paid to arm’s length individual contractors who are Ontario residents, who performed their work in Ontario that is directly attributable to the development of the eligible product. Only include remuneration incurred in the claim period, 37 months from the end of the month in which the product was completed, paid to individuals who provided their services to you as a sole proprietorship that did not have employees, or who provided their services personally through their Canadian loan-out corporation, meaning the individual owned the shares of the loan-out corporation, the corporation’s primary activity was the provision of that individual’s services and there were no employees of that corporation other than the individual.

A. Chain of Title Documentation

Please see help button for further instructions

Documentation of Ownership Rights to the Product: For example, Licensing Agreements, Rights Agreements, Co-production Agreements, Distribution Agreements for Eligible Products.

For Specified Products, Digital Games (93.1), and where applicable Digital Games (93.2), provide Fee-for-Service Agreement with purchaser corporation.

Indicate if this information is contained or attached under another product or application.

B. Description of Product Development or digital game activities (if applying under Section 93.1 or 93.2):

Please see help button for further instructions

Design and Technical Specification Documentation, where applicable, including a Flow Chart, Functional Design, a Description of the User Experience, Storyboard, a List of Technical Requirements and Specifications or Script.

Indicate if this information is contained or attached under another product or application.

C. Complete, Detailed Production Schedule and Timeline - Indicate if this information is contained or attached under another product or application.

D. Business and Marketing Plan including a Description…

Please see help button for further instructions

Where possible, include letters and or agreements that confirm interest and proposed terms from third-party distributors or equivalent.

E. Financing Plan/Indication of Sources of Financing for the… - Indicate if this information is contained or attached under another product or application.

F. Financing Contracts, if available (for all sources of financing) - Indicate if this information is contained or attached under another product or application.

G. A Cost Report or Schedule of Actual Eligible Ontario Labour.

Breakdown/schedule must conform to instructions in corresponding help button.

For Non-Specified and Specified Products include split of costs incurred:

- up to and including March 23, 2006;

- after March 23, 2006 up to and including March 25, 2008;

- after March 25, 2008 up to and including March 26, 2009;

- costs incurred March 27, 2009 and beyond.

The schedules should make a clear distinction between, and provide subtotals for:

- Qualifying Wage Amounts on account of salaries and wages of its employees

- Qualifying Remuneration Amounts paid to arms-length parties who are not employees of the corporation

Please note: There is no remuneration allowed for specified products prior to March 27, 2009.

See the Ontario Regulations Section 35 (1).

Indicate if this schedule is contained or attached under another product or application.

G. (93.1) A Cost Report or Schedule of Actual Qualifying Ontario Labour Expenditures incurred by a Qualifying Digital Game Corporation.

The schedules should make a clear distinction between, and provide subtotals for:

- Qualifying Wage Amounts on account of salaries and wages of its employees; and

- Qualifying Remuneration Amounts* paid to:

a) Arm’s length Ontario based individuals who are not employees of the corporation;

b) Arm’s length Ontario based individuals who deal at arm’s length with the qualifying digital game corporation for the services personally rendered by their employees;

c) Ontario based Canadian corporations for the services rendered personally by an Ontario based individual if the individual deals at arm’s length with the qualifying digital game corporation and is the sole shareholder of the corporation (i.e. personal services corporation);

d) Eligible partnerships for the services rendered personally by a member of the eligible partnership, or for services rendered personally by employees of the eligible partnership

The schedules should also identify costs incurred after March 26, 2009.

See the Ontario Regulations Section 35.1 (2)

To expedite the review please report each type of remuneration (items a-d above) included in claim in separate columns in cost report or schedule of actual qualifying Ontario labour expenditures submitted with the application. You may choose to use the OIDMTC Expenditure Breakdown for Qualifying Digital Game Corporations (93.1) template which is available on the OMDC website or you can access the link included on the Product Documents Checklist.

Indicate if this schedule is contained or attached under another product or application.

G. (93.2) A Cost Report or Schedule of Actual Qualifying Ontario Labour Expenditures incurred by a Specialized Digital Game Corporation.

The schedules should make a clear distinction between, and provide subtotals for:

- Qualifying Wage Amounts on account of salaries and wages of its employees; and

- Qualifying Remuneration Amounts* paid to:

a) Arm’s length Ontario based individuals who are not employees of the corporation;

b) Arm’s length Ontario based individuals who deal at arm’s length with the qualifying digital game corporation for the services personally rendered by their employees;

c) Ontario based Canadian corporations for the services rendered personally by an Ontario based individual if the individual deals at arm’s length with the qualifying digital game corporation and is the sole shareholder of the corporation (i.e. personal services corporation);

d) Eligible partnerships for the services rendered personally by a member of the eligible partnership, or for services rendered personally by employees of the eligible partnership

The schedules should also identify costs incurred after March 26, 2009.

See the Ontario Regulations Section 35.2 (1).

To expedite the review please report each type of remuneration (items a-d above) included in claim in separate columns in cost report or schedule of actual qualifying Ontario labour expenditures submitted with the application. You may choose to use the OIDMTC Expenditure Breakdown for Specialized Digital Game Corporations (93.2) template which is available on the OMDC website or you can access the link included on the Product Documents Checklist.

Indicate if this schedule is contained or attached under another product or application.

H. List of Names and Roles (with brief description) of All Individuals Working on the Product.

Please see help button for further instructions

Please include addresses.

To be Eligible Ontario Labour expenditures, each employee and contractor must be an Ontario resident as of December 31 of the year prior to the fiscal year being claimed. See OIDMTC Guideline Appendix 6-VII Income Tax Act (Ontario) clause 2(a).

OMDC generally does not need to see the Ontario Declaration of Residency/Consent Forms for OIDMTC, however we advise applicants to keep them on file as the Canada Revenue Agency may ask to see them should they decide to audit the claim.

I Schedule of Eligible Marketing and Distribution Expenses.

Breakdown/schedule must conform to instructions in corresponding help button.

Include split of costs incurred:

- up to and including March 23, 2006;

- after March 23, 2006 up to and including March 25, 2008;

- after March 25, 2008 up to and including March 26, 2009;

- costs incurred March 27, 2009 and beyond.

Not allowed for specified products or eligible digital games being claimed under Section 93.1 or 93.2. See the Taxation Act, S.O. 2007, Section 93(6). Indicate if this information is contained or attached another product or application.

J. Copy of the Completed Interactive Digital Product.

Please see help button for further instructions

We require a copy of each product, either CD-ROM, screen shot printouts showing interactivity, site map, recording of an interactive session, or other such means to put in our files, so that should a new version of a product be submitted, we can make a direct comparison.

If the product is a website, attach a copy of representative screen shots, and address where the product may be accessed at time of completion. Please include any password, registration or access codes that may be required to review the product.

K. Evidence or copy of each eligible digital game included in application

Please submit copies of completed eligible digital games if available. Other documentation to evidence development of eligible digital games may include detailed design or technical specification documents, working prototypes, mock ups, wire frames, copies of graphics and art assets created, game design documents, physics or game engine descriptions, etc. For websites, copy of all associated text and image files with address where the game may be accessed is required. Please include any password, registration or access codes that may be required to review the game.

L. Description of Product - Upload a document if you have not provided details in the text field in the Product Section.

M. Other Documents – Upload other supporting documents that are not listed in the document items listed above.

N. Government Assistance – means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. If government assistance is provided to the company for purposes other than developing the eligible product please contact OMDC on how to treat this. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada). IRAP- Industrial Research Assistance Program CETC- Cooperative Education Tax Credit.

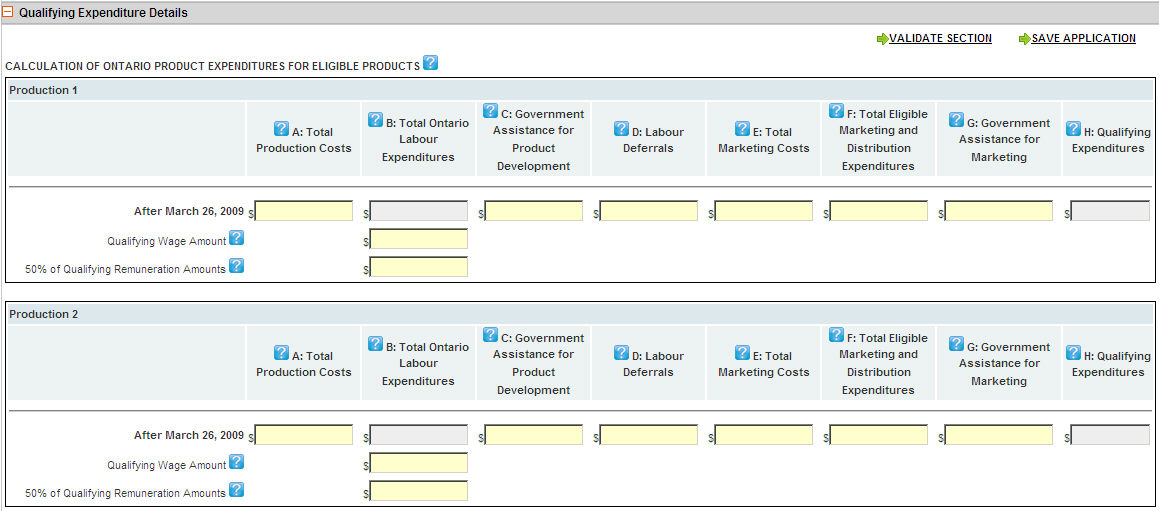

Filling out the Qualifying Expenditure Details Section:

Fill in all the applicable information as shown below.

Definitions for the Qualifying Expenditure Details for non-specified products Section:

A: Total Production Costs - Enter Total Cost of Production which should include any non-Ontario product development costs.

B: Total Paid Ontario Labour Expenditures - Enter gross paid amounts being claimed on account of salaries and wages of employees, before government assistance is deducted.

C: Government Assistance for Product Development - Enter the amount of government assistance that is attributable to the development of the product under column “C” in the OIDMTC calculation table. “Government assistance” means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. Note that government assistance received for marketing the eligible product is entered under column “G” in the OIDMTC Calculation table below. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada). If government assistance is provided to the company for purposes other than developing or marketing the product, please contact OMDC on how to treat this.

D: Total Marketing Costs - Enter the total of all marketing and distribution costs per OIDMTC period, including those being claimed.

E: Total Eligible Marketing and Distribution Expenditures - Enter gross amount being claimed, before government assistance is deducted. The net claim maximum is $100,000. Marketing and distribution expenditures can include arm’s length remuneration and non-Ontario costs.

F: Government Assistance for Marketing - Enter the amount of any government assistance that is attributable to the marketing or distribution of the product under column “G” in the OIDMTC Calculation table. “Government assistance” means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada). If government assistance is provided to the company for purposes other than developing or marketing the product, please contact OMDC on how to treat this.

G: Qualifying Expenditures - Automatically calculates the government assistance subtracted, or ‘grind’.

Qualifying Wage Amount - On account of salaries and wages of its employees.

50% of Qualifying Remuneration Amounts - Enter 50% of Qualifying Remuneration Amounts for this time period here.

Definitions for the Calculation of Ontario product expenditures for specified products Section:

A: Total Production Costs - Enter Total Cost of Production which should include any non-Ontario product development costs.

B: Total Paid Ontario Labour Expenditures - Enter gross paid amounts being claimed on account of salaries and wages of employees, before government assistance is deducted.

No marketing and distribution expenditures are allowed for specified products.

C: Government Assistance for Product Development - Enter the amount of government assistance that is attributable to the development of the product under column “C” in the OIDMTC calculation table. “Government assistance” means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada). If government assistance is provided to the company for purposes other than developing the product, please contact OMDC on how to treat this.

D: Qualifying Expenditures - Automatically calculates the government assistance subtracted, or ‘grind’.

Qualifying Wage Amount - On account of salaries and wages of its employees.

100% of Qualifying Remuneration Amounts - Enter 100% of Qualifying Remuneration Amounts for remuneration costs incurred after March 26, 2009.

Definitions for the Calculation of Ontario labour expenditures for Qualifying Digital Game Corporations (93.1) Section:

A: Total Development Costs - Enter Total Cost of Development which should include any non-Ontario product development costs.

B: Total Paid Ontario Labour Expenditures incurred after March 26, 2009 – This is a total of paid amounts entered as qualifying wages and salaries, and qualifying remuneration that is directly attributable to the development of the eligible digital game. These costs must be incurred after March 26, 2009 and within a 36-month period that ends in the taxation year.

C: Total Government Assistance – Enter the amount of any government assistance that is attributable to the development of the eligible digital game under column “C” in the OIDMTC Calculation table. “Government assistance” means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. If government assistance is provided to the company for purposes other than developing the eligible digital game, please contact OMDC on how to treat this. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada).

D: Qualifying Expenditures - Automatically calculates the government assistance subtracted, or ‘grind’.

Qualifying Wage Amount - On account of paid salaries and wages of its employees incurred after March 26, 2009.

Qualifying Remuneration Amounts - Enter Qualifying Remuneration Amounts for paid remuneration costs incurred after March 26, 2009.

Definitions for the Calculation of Ontario labour expenditures for Specialized Digital Game Corporations (93.2) Section:

A: Total Development Costs - Enter Total Cost of Development which should include any non-Ontario product development costs.

B: Total Paid Ontario Labour Expenditures incurred after March 26, 2009 – This is a total of paid amounts entered as qualifying wages and salaries, and qualifying remuneration that is directly attributable to the development of the eligible digital game incurred after March 26, 2009 and within the taxation year that the OIDMTC is being claimed.

C: Total Government Assistance – Enter the amount of any government assistance that is attributable to the development of the eligible digital game under column “C” in the OIDMTC Calculation table. “Government assistance” means assistance from a government, municipality or other public authority in any form, including a grant, subsidy, forgivable loan, deduction from tax and investment allowance, but not including a tax credit under Section 93 of the Taxation Act or section 43.11 of the Corporations Tax Act. If government assistance is provided to the company for purposes other than developing the eligible digital game, please contact OMDC on how to treat this. See OIDMTC Guideline Appendix 6-VIII Definition of “Assistance”, of Paragraph 12(1)(x) of the Income Tax Act (Canada).

D: Qualifying Expenditures - Automatically calculates the government assistance subtracted, or ‘grind’.

Qualifying Wage Amount - On account of paid salaries and wages of its employees incurred after March 26, 2009 and within the taxation year that the OIDMTC is being claimed.

Qualifying Remuneration Amounts - Enter Qualifying Remuneration Amounts for paid remuneration costs incurred after March 26, 2009 and within the taxation year that the OIDMTC is being claimed.

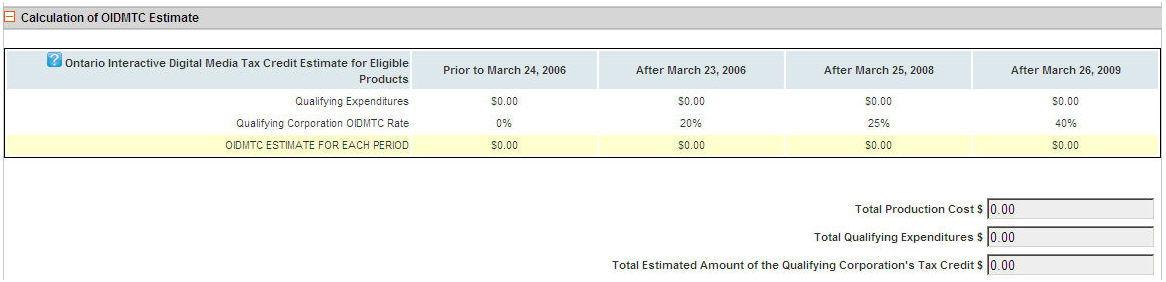

Filling out the Calculation of OIDMTC section:

Calculation of OIDMTC Estimate ![]() - Total

production costs are summed automatically from column A from the Non-Specified,

Specified and Digital Game products tables. Total Qualifying Expenditures

sums Column H from the Non-Specified Calculation Sheet, Column D from

the Specified Calculation Sheet, and Column D from the Digital Game Calculation

Sheets. Total Estimated Amount of the Qualifying Corporation's Tax Credit

sums the tax credit for all time periods in the Non-Specified, Specified,

and Digital Game tables.

- Total

production costs are summed automatically from column A from the Non-Specified,

Specified and Digital Game products tables. Total Qualifying Expenditures

sums Column H from the Non-Specified Calculation Sheet, Column D from

the Specified Calculation Sheet, and Column D from the Digital Game Calculation

Sheets. Total Estimated Amount of the Qualifying Corporation's Tax Credit

sums the tax credit for all time periods in the Non-Specified, Specified,

and Digital Game tables.

Fill in all the applicable information as shown below.

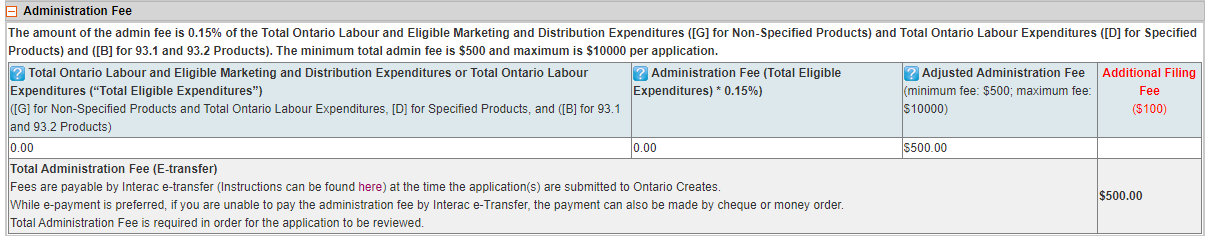

Filling out the Administration Fee Section:

Fill in all the applicable information as shown below.

Definitions for the Administration Fee Section:

Total Qualifying Expenditures - Automatically sums [G] for all Non-Specified Products and [D] for all Specified Products, all Eligible Digital Games (93.1), and all Eligible Digital Games (93.2)

Administration Fee - Automatically calculates the fee as Total Qualifying Expenditures * 0.1%.

Adjusted Administration Fee (minimum fee: $100; maximum fee: $2,000) - Automatically calculates the minimum or maximum fee. The administration fee is non-refundable.

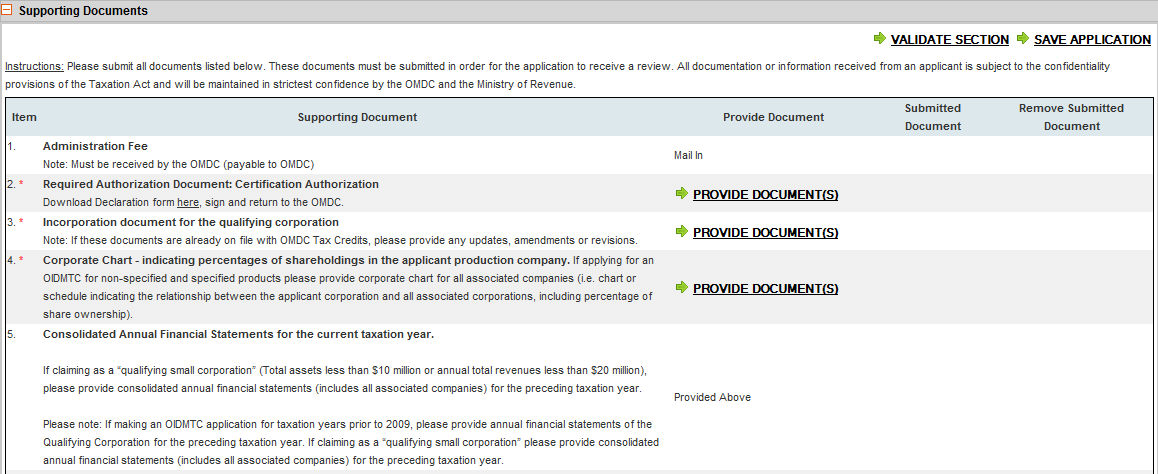

Supporting Documents:

Please see Section 3 of Create Industry Development Program for detailed instructions.

Definitions for Supporting Documents:

1. Administration Fee - Must be received by the OMDC before a Certificate of Eligibility is issued. Cheque, money order, or bank draft accepted only.

2. Required Authorization Document: Certification Authorization - There is only one such authorization per application, and it needs to be updated, signed, and submitted for each fiscal year application.

3. Incorporation documents for the qualifying corporation - This includes the entire certificate of incorporation and any updates, amendments, or revisions.

Please note that applicants need to upload and attached their corporate documents for each OIDMTC application. You may wish to load your corporate documents into a Corporate Documents Bank that is available to the applicant corporation on the OMDC Online Portal. For each new application you can then drag and drop these files into the appropriate section of a new application as required without having to upload the same documents for each application.

4. Corporate Chart - indicating percentages of shareholdings in the applicant production company.

Note: If applying for an OIDMTC for non-specified and specified products please provide corporate charts for all associated corporations.

Please note that applicants need to upload and attached their corporate documents for each OIDMTC application. You may wish to load your corporate documents into a Corporate Documents Bank that is available to the applicant corporation on the OMDC Online Portal. For each new application you can then drag and drop these files into the appropriate section of a new application as required without having to upload the same documents for each application.

5. Consolidated Annual Financial Statements for the current taxation year

Please note: If making an OIDMTC application for taxation years prior to 2009, please provide annual financial statements of the Qualifying Corporation for the preceding taxation year. If claiming as a “qualifying small corporation” (Total assets less than $10 million or annual total revenues less than $20 million), please provide consolidated annual financial statements (includes all associated companies) for the preceding taxation year.

6. Detailed Payroll report or Wage Schedule – This is required for companies applying under Section (93.2) as a Specialized Digital Game Corporation. The detailed Payroll Report or Wage Schedule should list names of all employees, their addresses and job description and relate to those wages and salaries incurred in the taxation year in which the Specialized Digital Game Corporation is making their annual OIDMTC claim.

7. (A) Chain of Title Documentation

Please see help button for further instructions

Documentation of Ownership Rights to the Product: For example, Licensing Agreements, Rights Agreements, Co-production Agreements, Distribution Agreements for Eligible Products.

For Specified Products, Digital Games (93.1), and where applicable Digital Games (93.2), provide Fee-for-Service Agreement with purchaser corporation.

Indicate if this information is contained or attached under another product or application.

8. (B) Description of Product Development or digital game activities (if applying under Section 93.1 or 93.2):

Please see help button for further instructions

Design and Technical Specification Documentation, where applicable, including a Flow Chart, Functional Design, a Description of the User Experience, Storyboard, a List of Technical Requirements and Specifications or Script.

Indicate if this information is contained or attached under another product or application.

9. (C) Complete, Detailed Production Schedule and Timeline - Indicate if this information is contained or attached under another product or application.

10. (D) Business and Marketing Plan including a Description… - Please see help button for further instructions. Where possible, include letters and or agreements that confirm interest and proposed terms from third-party distributors or equivalent.

11. (E) Financing Plan/Indication of Sources of Financing for the… - Indicate if this information is contained or attached under another product or application.

12. (F) Financing Contracts, if available (for all sources of financing) - Indicate if this information is contained or attached under another product or application.

13. (G) A Cost Report or Schedule of Actual Eligible Ontario Labour.

Breakdown/schedule must conform to instructions in corresponding help button.

For Non-Specified and Specified Products include split of costs incurred:

- up to and including March 23, 2006;

- after March 23, 2006 up to and including March 25, 2008;

- after March 25, 2008 up to and including March 26, 2009;

- costs incurred March 27, 2009 and beyond.

The schedules should make a clear distinction between, and provide subtotals for:

- Qualifying Wage Amounts on account of salaries and wages of its employees

- Qualifying Remuneration Amounts paid to arms-length parties who are not employees of the corporation

Please note: There is no remuneration allowed for specified products prior to March 27, 2009.

See the Ontario Regulations Section 35 (1).

Indicate if this schedule is contained or attached under another product or application.

14. (G) (93.1) A Cost Report or Schedule of Actual Qualifying Ontario Labour Expenditures incurred by a Qualifying Digital Game Corporation.

The schedules should make a clear distinction between, and provide subtotals for:

- Qualifying Wage Amounts on account of salaries and wages of its employees; and

- Qualifying Remuneration Amounts* paid to:

e) Arm’s length Ontario based individuals who are not employees of the corporation;

f) Arm’s length Ontario based individuals who deal at arm’s length with the qualifying digital game corporation for the services personally rendered by their employees;

g) Ontario based Canadian corporations for the services rendered personally by an Ontario based individual if the individual deals at arm’s length with the qualifying digital game corporation and is the sole shareholder of the corporation (i.e. personal services corporation);

h) Eligible partnerships for the services rendered personally by a member of the eligible partnership, or for services rendered personally by employees of the eligible partnership

The schedules should also identify costs incurred after March 26, 2009.

See the Ontario Regulations Section 35.1 (2)

To expedite the review please report each type of remuneration (items e-h above) included in claim in separate columns in cost report or schedule of actual qualifying Ontario labour expenditures submitted with the application. You may choose to use the OIDMTC Expenditure Breakdown for Qualifying Digital Game Corporations (93.1) template which is available on the OMDC website or you can access the link included on the Product Documents Checklist.

Indicate if this schedule is contained or attached under another product or application.

15. (G) (93.2) A Cost Report or Schedule of Actual Qualifying Ontario Labour Expenditures incurred by a Specialized Digital Game Corporation.

The schedules should make a clear distinction between, and provide subtotals for:

- Qualifying Wage Amounts on account of salaries and wages of its employees; and

- Qualifying Remuneration Amounts* paid to:

e) Arm’s length Ontario based individuals who are not employees of the corporation;

f) Arm’s length Ontario based individuals who deal at arm’s length with the qualifying digital game corporation for the services personally rendered by their employees;

g) Ontario based Canadian corporations for the services rendered personally by an Ontario based individual if the individual deals at arm’s length with the qualifying digital game corporation and is the sole shareholder of the corporation (i.e. personal services corporation);

h) Eligible partnerships for the services rendered personally by a member of the eligible partnership, or for services rendered personally by employees of the eligible partnership

The schedules should also identify costs incurred after March 26, 2009.

See the Ontario Regulations Section 35.2 (1).

To expedite the review please report each type of remuneration (items e-h above) included in claim in separate columns in cost report or schedule of actual qualifying Ontario labour expenditures submitted with the application. You may choose to use the OIDMTC Expenditure Breakdown for Specialized Digital Game Corporations (93.2) template which is available on the OMDC website or you can access the link included on the Product Documents Checklist.

Indicate if this schedule is contained or attached under another product or application.

16. (H) List of Names and Roles (with brief description) of All Individuals Working on the Product.

Please see help button for further instructions

Please include addresses.

To be Eligible Ontario Labour expenditures, each employee and contractor must be an Ontario resident as of December 31 of the year prior to the fiscal year being claimed. See OIDMTC Guideline Appendix 6-VII Income Tax Act (Ontario) clause 2(a).

OMDC generally does not need to see the Ontario Declaration of Residency/Consent Forms for OIDMTC, however we advise applicants to keep them on file as the Canada Revenue Agency may ask to see them should they decide to audit the claim.

17.(I) Schedule of Eligible Marketing and Distribution Expenses.

Breakdown/schedule must conform to instructions in corresponding help button.

Include split of costs incurred:

- up to and including March 23, 2006;

- after March 23, 2006 up to and including March 25, 2008;

- after March 25, 2008 up to and including March 26, 2009;

- costs incurred March 27, 2009 and beyond.

Not allowed for specified products or eligible digital games under Section 93.1 or 93.2. See the Taxation Act, S.O. 2007, Section 93(6). Indicate if this information is contained or attached another product or application.

18.(J) Copy of the Completed Interactive Digital Product.

Please see help button for further instructions

We require a copy of each product, either CD-ROM, screen shot printouts showing interactivity, site map, recording of an interactive session, or other such means to put in our files, so that should a new version of a product be submitted, we can make a direct comparison.

If the product is a website, attach a copy of representative screen shots, and address where the product may be accessed at time of completion. Please include any password, registration or access codes that may be required to review the product.

19. (K) Evidence or copy of each eligible digital game included in application

Please submit copies of completed eligible digital games if available. Other documentation to evidence development of eligible digital games may include detailed design or technical specification documents, working prototypes, mock ups, wire frames, copies of graphics and art assets created, game design documents, physics or game engine descriptions, etc. For websites, copy of all associated text and image files with address where the game may be accessed is required. Please include any password, registration or access codes that may be required to review the game.

20. (L) Description of Product - Upload a document if you have not provided details in the text field in the Product Section.

21. (M) Other Documents – Upload other supporting documents that are not listed in the document items listed above.

Once you have completed all sections of the Tax

Credit Application, click the  button to submit

your application to OMDC.

button to submit

your application to OMDC.