Click on the  link.

link.

Create OSRTC Tax Credit Application

Please Note:

Applications will only enter the queue to be reviewed on a first come, first served basis.

In an effort to streamline our tax credit administration process, please note that starting April 1, 2011, the OMDC is implementing a mandatory policy that all OMDC tax credit applications must be submitted via our Online Application Portal and all requested documents must be uploaded through the OMDC portal.

A red Asterix * beside a field in the application form, or beside checklist items for requested documents indicates that those items are mandatory and must be completed or those specific documents must be attached in order to proceed with the application.

Applications can be made for prior fiscal years as long as that fiscal year is not statute barred. To determine statute barred status, the applicant can contact Canada Revenue Agency (CRA). If not statute barred, the applicant can amend a previously filed tax return with CRA, with the amount of the OSRTC Certificate entered. It is the applicantís responsibility to ensure that they are not statute barred from amending a tax return for a previous fiscal year.

Please consult the CRA web site for more information on statute barred dates: http://www.cra-arc.gc.ca/E/pub/tp/ic07-1/ic07-1-e.html#P261_36138 or call 416-973-3407.

Create an OSRTC Tax Credit Application:

Click on the  link.

link.

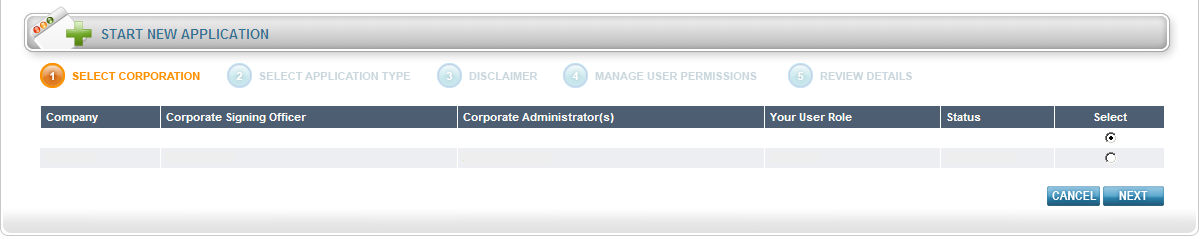

The Applications

page will display as shown below.

Using the radial check

boxes under the Select column,

select your desired Company and

click  . The following page will display.

. The following page will display.

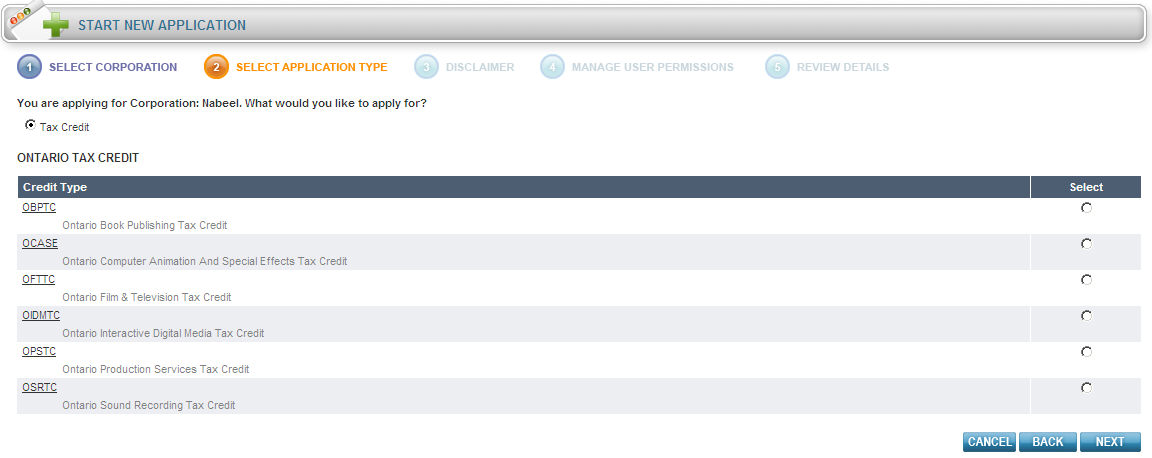

Ensure the Tax Credit radial box is checked off.

Under the Select

column, select OSRTC and click

.

.

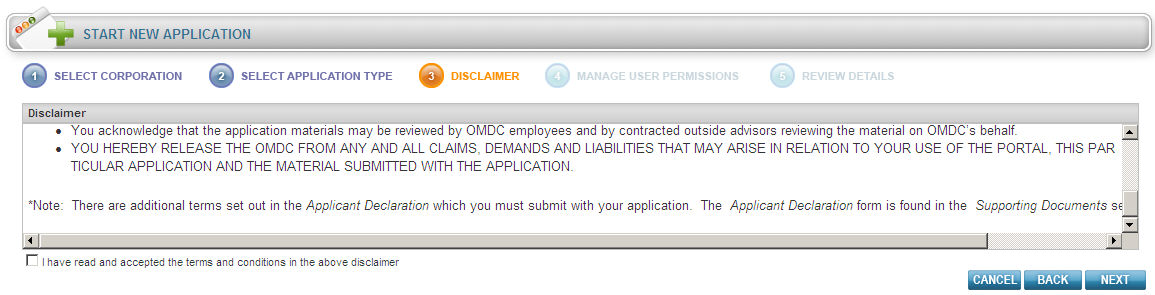

The Disclaimer page will display.

Check the "I have read and accepted the terms and conditions

for the above disclaimer" radial box and click  .

.

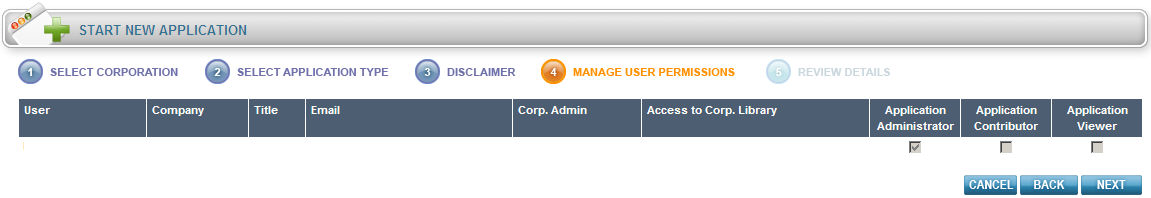

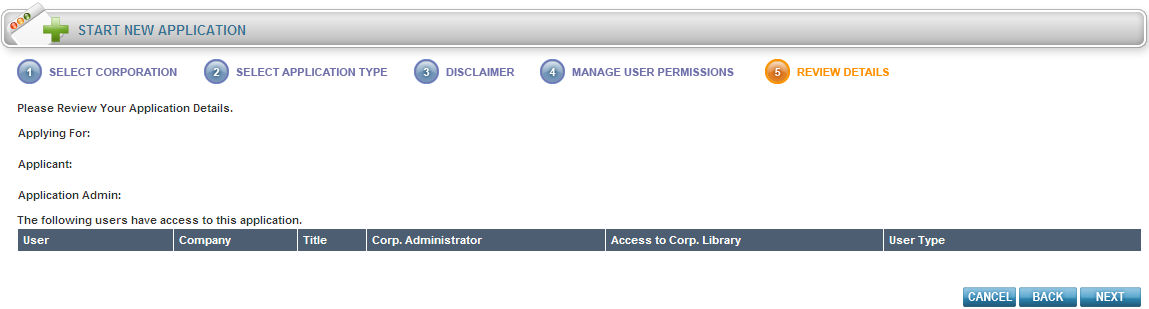

The Manage Users Permission page will display.

Using the Application

check boxes, select the User Permission

and click  . The Review

Details page will display as shown below to ensure the information

you have entered is correct.

. The Review

Details page will display as shown below to ensure the information

you have entered is correct.

Click  .

.

Filling out the General, Corporation Details, Sound Recording Details, Calculation of OSRTC Estimate, Administration Fee and Supporting Documents Sections:

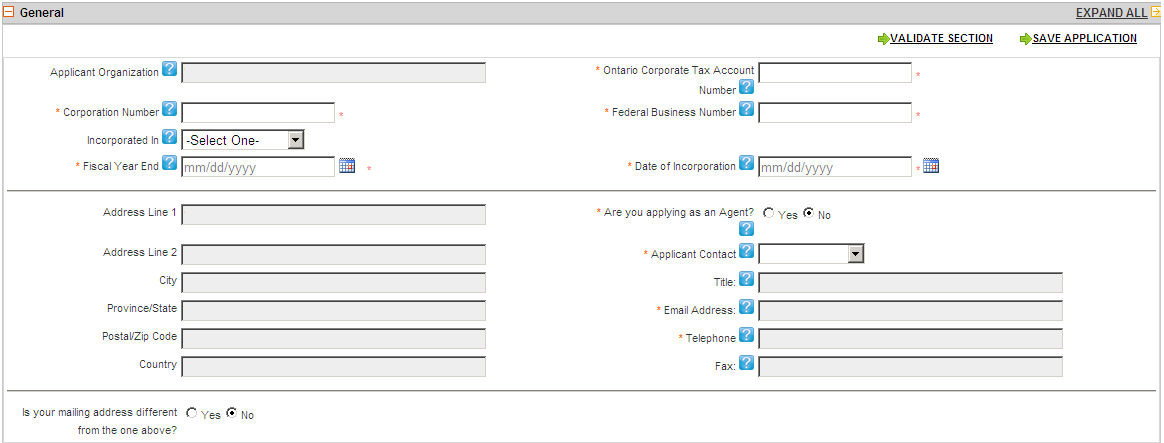

Filling out the General section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validated the content is correctly/incorrectly filled in.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the General Section:

Applicant Organization - This is the corporationís legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Ontario corporate tax account number - The Ontario Corporate Tax Account Number is issued by the Province for companies filing tax returns for fiscal years ending before January 1, 2009. This number is being replaced by the Federal Business Number for fiscal years ending in 2009 and beyond.

Corporation number - The Corporation Number is listed on the Articles or Certificate of Incorporation.

Federal business number - The Federal Business Number is replacing the Ontario Corporate Tax Account Number for fiscal years ending in 2009 and beyond.

Incorporated in - This is the jurisdiction where the company is incorporated.

Fiscal year end - Enter the end of your companyís fiscal year for the current application. If you have not filed a corporate tax return yet, please enter the anticipated year end date.

Date of incorporation - Enter the date of incorporation as indicated on the Articles of Incorporation.

Are you applying as an Agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicantís consent.

Contact - Please select the primary contact from the dropdown list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contactís title. It can be changed in the User Profile.

Email - This is the contactís email. It can be changed in the User Profile.

Telephone - This is the contactís telephone. It can be changed in the User Profile.

Fax - This is the contactís fax. It can be changed in the User Profile.

Lyric Credits - Enter the information requested below for each lyricist on the sound recording. Residency refers to principal residency. Eligible lyricists must be Canadian citizens or permanent residents.

Music Credits - Enter the information requested below for each composer on the sound recording. Residency refers to principal residency. Eligible composers must be Canadian citizens or permanent residents.

Recording Studio used for Production of Recording - Enter the information requested below for studio used for production of recording.

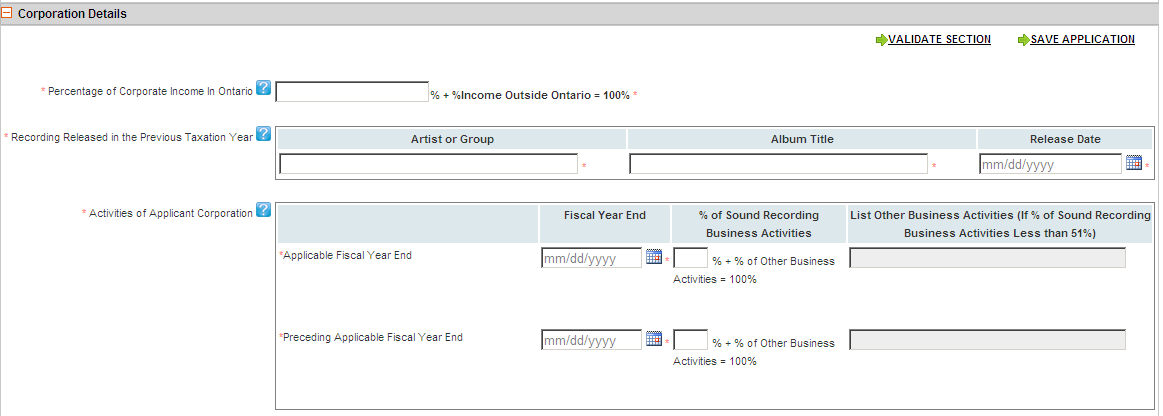

Filling out the Corporation Detail Section:

Fill in all the applicable information as shown below.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display

Definitions for the Corporation Details Section:

Percentage of Corporate Income in Ontario - Enter the percentage of your corporate income which was earned in Ontario and claimed for the preceding fiscal year on the corporate tax return.

Recording Released in the Previous Taxation Year - List a recording which was released in the fiscal year previous to the year for which the tax credit is being claimed.

Activities of Applicant Corporation - Enter the percentage of your business activities which are sound recording activities. A sound recording company and its activities is defined in Subsection 905 (3) of OSRTC Regulations.

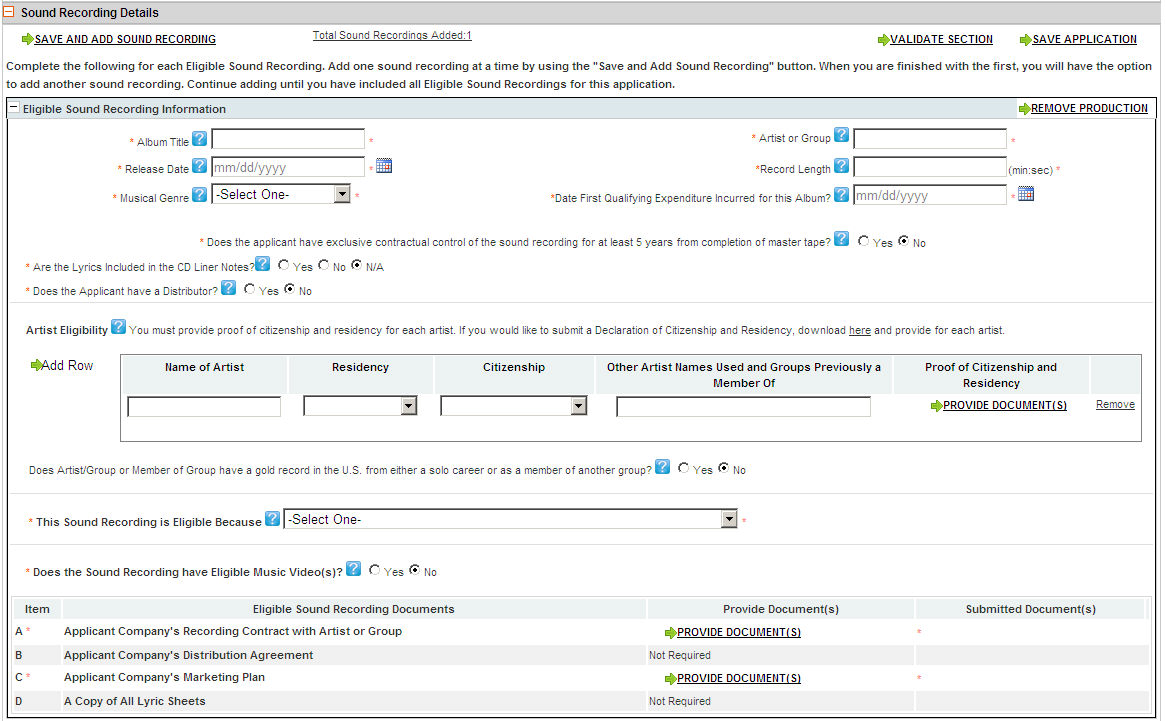

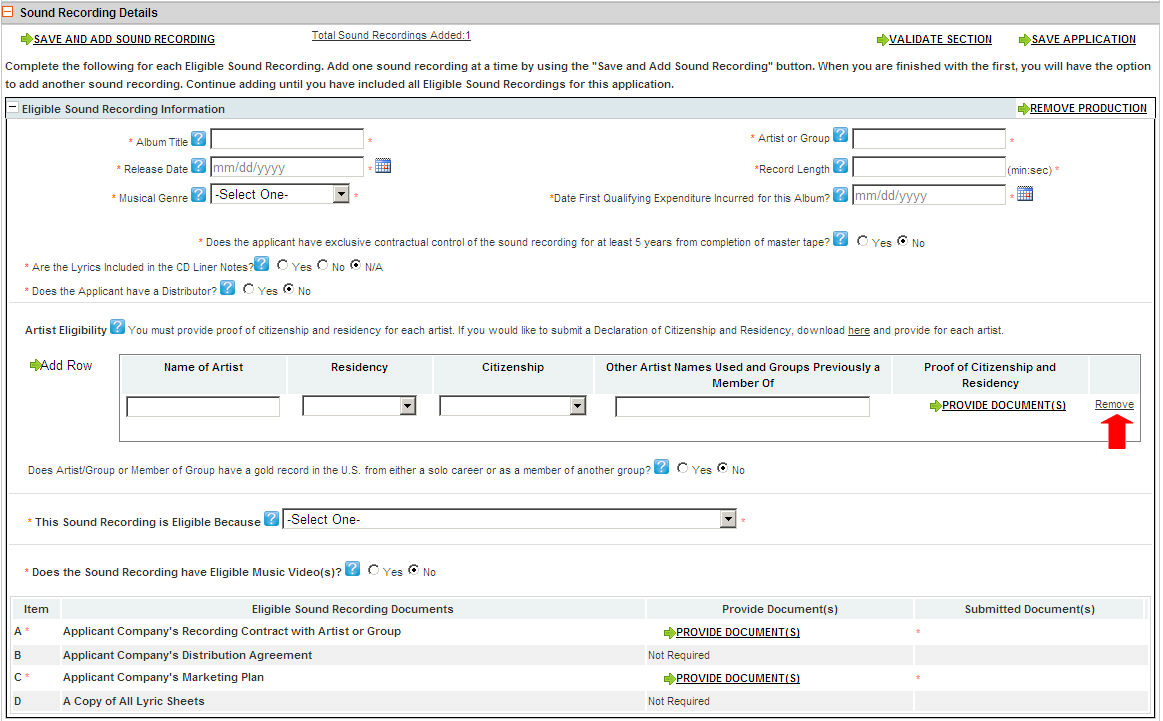

Filling out the Sound Recording Details:

Fill in all the applicable information as shown below.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Add Sound Recording:

Click the  button.

button.

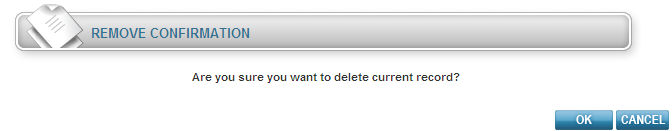

Remove a Sound Recording

Click the Remove link as shown below.

The following pop-up will display.

Click OK or click Cancel.

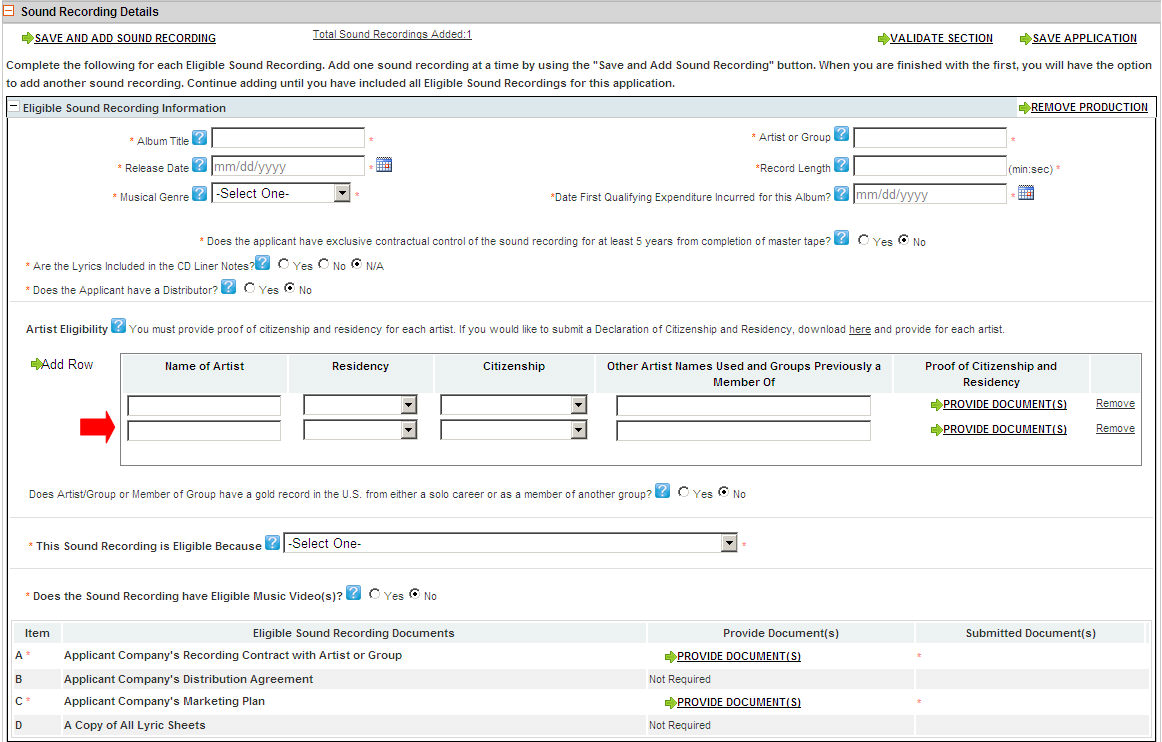

Add a Row:

Click the  button.

button.

An additional field will display as shown below.

Enter in your desired information.

Definitions for the Sound Recordings Details Section:

Album Title - Enter the title of the sound recording.

Artist or Group - Enter the name of the recording artist or group.

Release Date - Enter the date that the sound recording was released.

Record Length - Enter the length of the sound recording.

Musical Genre - Select the applicable music genre provided in the drop down list.

Date First Qualifying Expenditure Incurred for this Album - Enter the date in which you incurred the first expense for the sound recording. Note: you are allowed to claim eligible expenditures 24 months after this date.

Date Master Recording was Completed

Does the applicant have exclusive contractual control of the sound recording for at least 5 years from completion of master tape? -Enter yes or no. Applicant must have exclusive control of the recording for a minimum of 5 years in order for the recording to be eligible for OSRTC.

Are the Lyrics Included in the CD Liner Notes? - Enter yes or no. If no, please provide a copy.

Does the Applicant have a Distributor? - Enter yes or no.

Artist Eligibility - Enter the information requested below for each artist appearing on the sound recording. Enter the name of the artist and any known aliases (akaís). Residency refers to principal residency. Eligible artists must be Canadian citizens or permanent residents. Emerging Canadian artist or group is defined in Section 905 (4) of OSRTC Regulations.

Gold Record (in USA)? - Does emerging Artist or Member of Group have a gold record in the U.S. from either a solo career or as a member of another group? Emerging Canadian artist or group is defined in Section 905 (4) of the OSRTC Regulations.

This Sound Recording is Eligible Because - Select the criterion by which the sound recording qualifies for the tax credit.

How many individual tracks are on the recording -

Does the Sound Recording have Eligible Music Video(s)? - Enter yes or no. An eligible music video is defined in Section 905 (12) of OSRTC Regulations.

Applicant company's recording contract with artist or group -

Applicant company's distribution agreement -

Applicant company's marketing plan -

A copy of all lyric sheets -

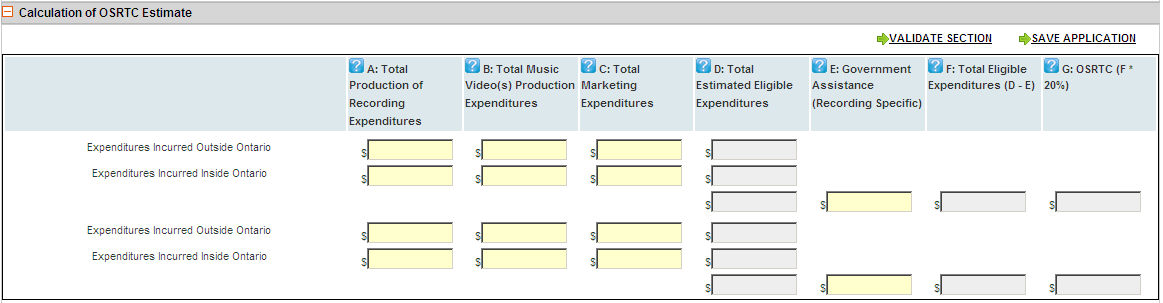

Filling out the Calculation of OSRTC Estimate Section:

Fill in all the applicable information as shown below.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the Sound Recordings Details Section:

A: Total Production of Recording Expenditures - Enter the amount of the total costs of recording from start to finish.

B: Total Music Video(s) Production Expenditures - Enter the amount of the total costs of video production from start to finish.

C: Total Marketing Expenditures - Enter the amount of the total cost of marketing from start to finish.

D: Total Estimated Eligible Expenditures - Expenditures incurred in Ontario are for property used and services provided primarily in Ontario.

E: Government Assistance (Recording Specific) - This includes government assistance specific to this recording. FACTOR is not considered government assistance.

F: Total eligible expenditures (D - E) -

Filling out the Administration Fee section:

Fill in all the applicable information as shown below.

Definitions for the Administration Fee Section:

Total eligible expenditures -

Administration fee -

Adjusted administration fee -

Supporting Documents:

Please see Section 3 of Create Industry Development Program for detailed instructions.

Definitions for Supporting Documents:

A Copy of each Sound Recording as Released on CD or DVD -

Required Authorization Document: Applicant Declaration -

Incorporation Documents for the Applicant Company - This is either an Article of Incorporation or a Certificate of Incorporation.

Applicant Company's Most Recent Financial Statements -

Taxpayer Authorization to Exchange Information Form -

List of Applicant Company's Shareholders or Corporate Chart for Applicable Fiscal year -

Most Recent Copy of Company's Catalogue/List of Sound Recordings Including Distributor(s) -

Applicant Company's Distribution Agreement(s) or Marketing Plan(s) -

Applicant Corporations Recording Contract with Artist or Group -

A Copy of All Lyric Sheets for Sound Recordings where Lyrics are NOT included in CD Liner Notes -

Proof of Citizenship and Residency for each Artist or Group Member listed for each Sound Recording. - A Declaration of Citizenship and Residency can be used to confirm citizenship and residency.

Proof of Citizenship and Residency for each Lyricist, Composer or Music Video Director for each Sound Recording. - A Declaration of Citizenship and Residency can be used to confirm citizenship and residency, if not already submitted for the above.

A Copy of all Music Video(s) for Each Sound Recording on DVD format (where applicable) -

Once you have completed all sections of the Tax

Credit Application, click the  button to submit

your application to OMDC.

button to submit

your application to OMDC.