Click on the  link.

link.

Create OCASE Tax Credit Application

Please Note:

Applications will only enter the queue to be reviewed on a first come, first served basis once all required information and documentation has been entered and uploaded.

Although some of the March 26 2009 Budget Proposed OCASE enhancements are included in this form, not all of the enhancements are reflected in this form at this time.

Only 1 application per fiscal year can be filed, which must contain all eligible productions worked on in that fiscal year. For example, for a July 31 2008 fiscal year end, a production with costs incurred between August 1 2007 to July 31 2008 would be submitted in the 2008 fiscal year OCASE claim, while a production with costs incurred between August 1 2008 to July 31 2009 would be submitted in a 2009 fiscal year OCASE claim.

Applications can be made for prior fiscal years as long as that fiscal year is not statute barred. To determine statute barred status, the applicant can contact Canada Revenue Agency (CRA). If not statute barred, the applicant can amend a previously filed tax return with CRA, with the amount of the OCASE certificate entered. It is the applicant’s responsibility to ensure that they are not statute barred from amending a tax return for a previous fiscal year.

Please consult the CRA website for more information on statute barred dates. http://www.cra-arc.gc.ca/E/pub/tp/ic07-1-e.html#P261_36138 or at 416-973-3407.

Create an OCASE Tax Credit Application:

Click on the  link.

link.

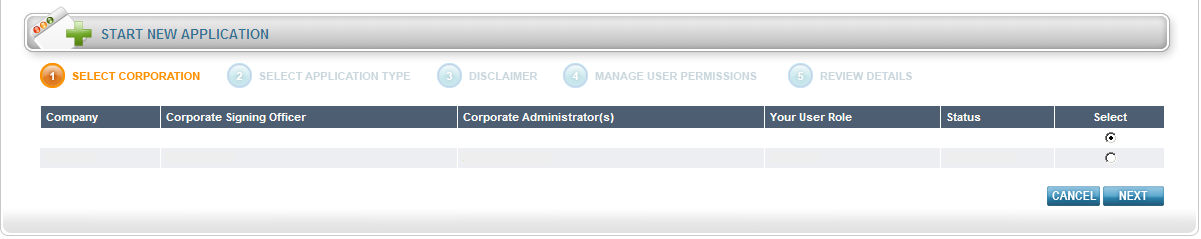

The Applications

page will display as shown below.

Using the radial check

boxes under the Select column,

select your desired Company and

click  . The following page will display.

. The following page will display.

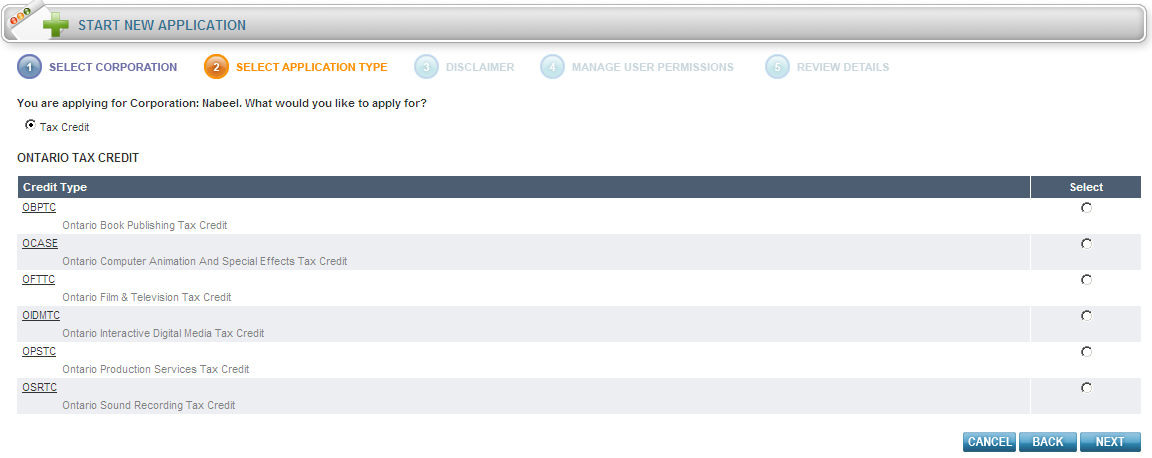

Ensure the Tax Credit radial box is checked off.

Under the Select

column, select OCASE and click

.

.

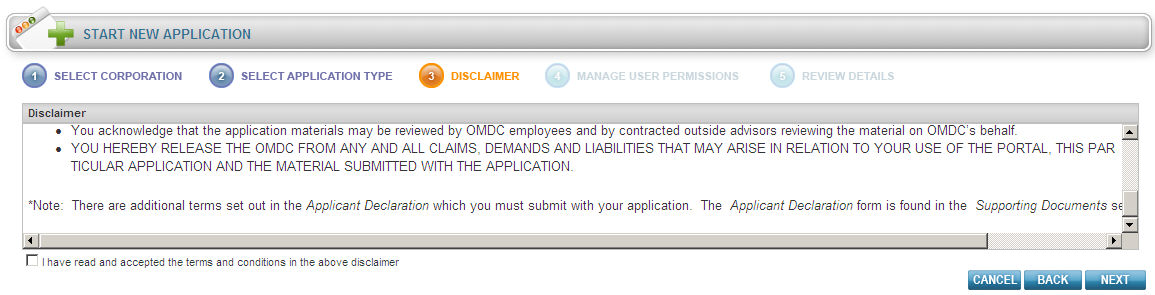

The Disclaimer page will display.

Check the "I have read and accepted the terms and conditions

for the above disclaimer" radial box and click  .

.

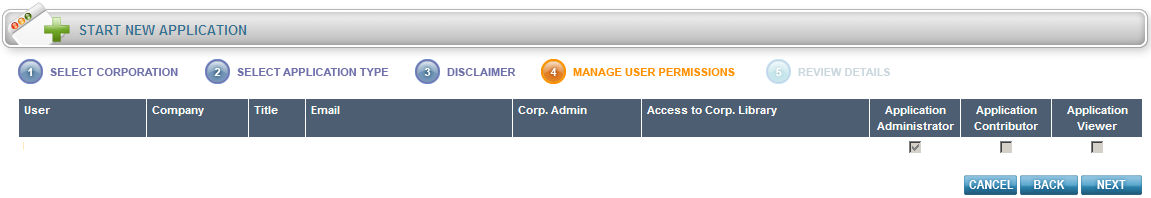

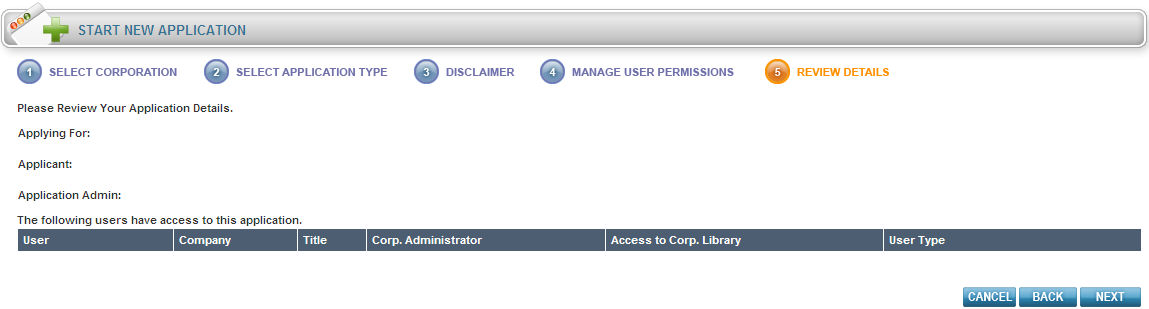

The Manage Users Permission page will display.

Using the Application

check boxes, select the User Permission

and click  . The Review

Details page will display as shown below to ensure the information

you have entered is correct.

. The Review

Details page will display as shown below to ensure the information

you have entered is correct.

Click  .

.

Filling out the General, Production, Calculation of OCASE Estimate, Administration Fee and Supporting Documents Sections:

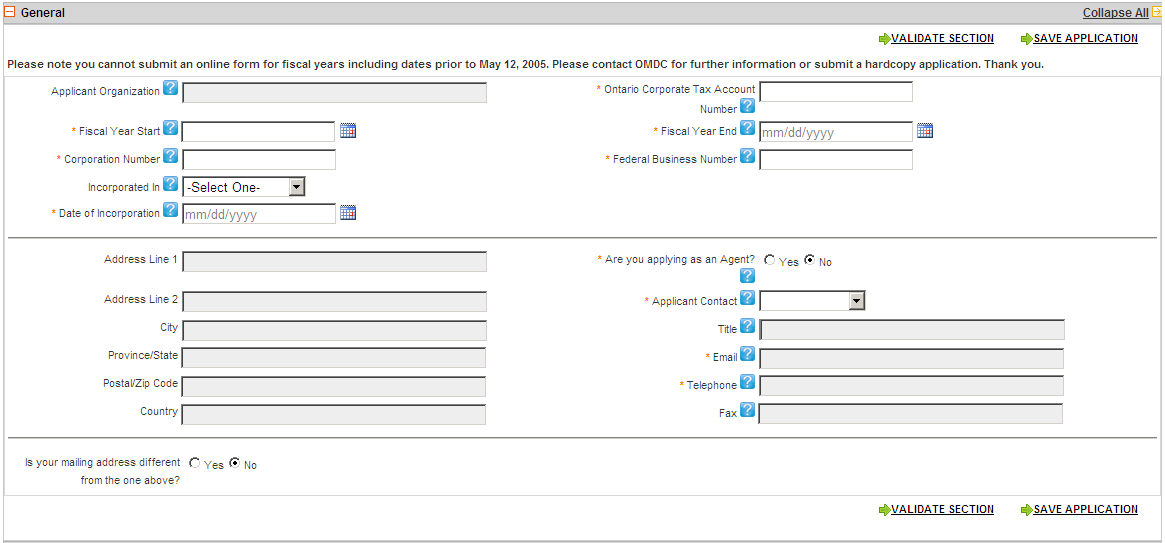

Filling out the General section:

Fill in all the applicable information as shown below.

To use the Calendar

function, click on the  icon. The calendar will display as

shown below.

icon. The calendar will display as

shown below.

Click the right or left arrow keys shown above to scroll through the months or click directly on a day to populate that day.

Note: You may click the Save Application button as often as you need.

After you have filled in a section on ANY

Tax Credit Form, click the  button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

button to ensure you have filled

that portion of the form out correctly. If the validation is okay, the

header will change to green.

Note: By clicking on the Validate Section button the section will NOT be saved but only validated the content is correctly/incorrectly filled in.

If you are unclear about a certain field, click the  icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

icon, this will take you to the specific section of the Online

Help File where a definition for that field will display.

Definitions for the General Section:

Applicant organization - This is the corporation’s legal name as entered in the Corporate Profile. If you would like to make changes to this field, please return to the Corporate Profile.

Ontario corporate tax account number - The Ontario Corporate Tax Account Number is issued by the Province for companies filing tax returns for fiscal years ending before January 1, 2009. This number is being replaced by the Federal Business Number for fiscal years ending in 2009 and beyond.

Fiscal Year Start - Enter the start of your company’s fiscal year for the current application.

Fiscal Year End - Enter the end of your company’s fiscal year for the current application.

Corporation Number - The Corporation Number is different from the Ontario Corporate Tax Account Number. This is the number on the Articles of Incorporation.

Federal Business Number - The Federal Business Number is replacing the Ontario Corporate Tax Account Number for fiscal years ending in 2009 and beyond.

Incorporated In - This is the jurisdiction where the company is incorporated.

Are you applying as an Agent? - An agent applies for a tax credit on behalf of the applicant corporation with the applicant’s consent.

Contact - Please select the primary contact from the dropdown list. To add another name, please have the application administrator grant the appropriate permission.

Title - This is the contact’s title. It can be changed in the User Profile.

Email - This is the contact’s email. It can be changed in the User Profile.

Telephone - This is the contact’s telephone. It can be changed in the User Profile.

Fax - This is the contact’s fax. It can be changed in the User Profile.

Ontario Full-Time Equivalent (FTE) positions - The Ministry of Tourism, Culture and Sport has requested that OMDC collect this data to understand the impact of support to these sectors. An FTE is defined as a work week of approximately 35-40 weeks over the life of the project. For example:

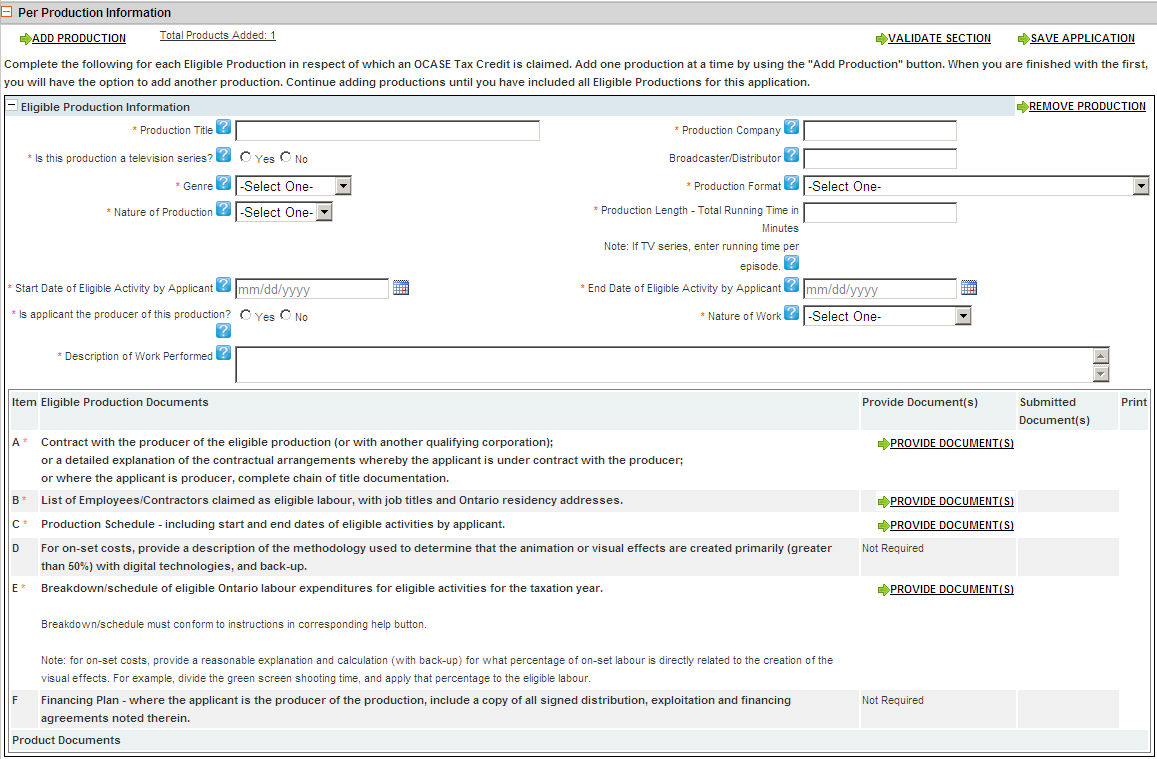

Filling out the Per Production Information Section:

Fill in all the applicable information as shown below.

If you wish to remove a Production,

simply click the  button. The following pop-will display:

button. The following pop-will display:

Click OK or click Cancel.

To Add a Production,

click the  button and fill out the applicable information.

button and fill out the applicable information.

Definitions for the Production Details Section:

Have you provided notice to OMDC of your intent to apply for the grandfathering of the OCASE tax credit rate? - Only submit an agreement under ii) if no agreement exists for i)

Have you previously submitted a Notice of Intent to apply for OCASE Grandfathering? - OCASE Tax Credit rate for expenditures after April 23, 2015 is 18%. Productions that had entered into a written agreement with arm’s length parties prior to April 24, 2015 and for which PP/Key Animation began between August 1, 2015 and November 30, 2015 may be eligible for some relief in the form of a grant.

Production Title - Please include the full title of the production. Accuracy is important as it helps the OMDC identify the correct production.

Production Company - Please indicate the name of the production company that produced the production. This is not the animation studio or vfx studio.

Is this production a television series? - Yes or No

Broadcaster/Distributor - The name of the broadcaster who will air the production or the name of the distributor who will distribute the production.

Genre - Select from one of the drop-down menu choices.

Nature of Production - Please indicate whether the production is a live action, animated production or a combination of both live action and animation.

Production Length – Total running time in Minutes – Note: If TV series, enter running time per episode - Ie: if each episode is 30 minutes in length, enter 30

.Start Date of Eligible Activity by Applicant - This refers to the date that the applicant company commenced animation or vfx work on the production, not the start of principal photography or key animation. Please note that you can only include costs that were incurred in the current fiscal; therefore this date must be the same or later than the date of the current fiscal start.

End Date of Eligible Activity by Applicant - This refers to the last day that the applicant incurred costs for the production in the current fiscal year. This date does not refer to the end of production. If you incurred costs into your next fiscal, kindly note that you must submit a separate OCASE application for the following fiscal year in which you can claim the remainder of any costs you incurred on productions that straddle 2 fiscal years.

Are you providing VFX services or digital animation services to the production company or production services company? - Please answer YES to this question if you are only providing VFX services or digital animation services to the production company or the production services company.

Are you claiming activities during the production period? - Production Period is the start of prep to the end of principal photography.

Are you claiming activities post-production?

What portion of this production’s claim is for work done in Ontario prior to the start of principal photography? - Please identify the percentage and amount of the labour you are including in your OCASE claim that occurred during the pre-production period ( prior to the start of principal photography).

What is the percentage of VFX labour within this production? - VFX percentage calculation: Calculating the eligible percentage of labour that relates directly to VFX (the VFX %):

Not every scene of your production will have visual effects applied, so only a percentage of the work being performed can reasonably be said to be directly in support of the creation of the visual effect. We call this the VFX %. In order to determine what percentage of your labour is eligible to be claimed for OCASE, we accept various methods of calculation, as long as the method is reasonable and you are able to verify the VFX % through documentation.

Our preferred method of calculation is the ratio of hours spent shooting VFX divided by the total hours shooting on the day, averaged for the total number of (Main Unit or Second Unit) filming days. We consider this the most accurate estimate.

Note: The VFX percentage should be calculated on principal photography days for the main unit only. For any secondary or splinter unit days a separate VFX percent must be calculated and applied to eligible labour incurred on the second unit

If you have second or splinter unit filming days during the principal photography period that were directly in support of visual effects, use the same methodology as above to determine the VFX % for the second/splinter unit filming days. The preferred method is time spent shooting visual effects divided by total shooting time. Other possibilities are VFX set-ups divided by total set-ups, shots, scenes, etc.

Please see Primer for “Producers OCASE Claim” for further details.

What is the method used to determine the VFX labour percentage of this production? - Please see Table 1 in Primer for “Producers OCASE Claim” for further details.

Please indicate the method used to determine the VFX labour percentage for second unit days - Please see Table 1 in Primer for “Producers OCASE Claim” for further details.

Nature of Activities - Please indicate what work the applicant completed on the production. This is not referring to the production as a whole, but instead focusing on the work that the applicant completed.

Detailed Description of Work Performed - Please provide a detailed description of the process by which the animation or visual effects are created; including a list and description of the digital technologies and software used.

Were all activities for this OCASE claim performed in Ontario? - Only work performed in Ontario is eligible for the OCASE tax credit.

To Provide Supporting Documents:

Please see Section 3 of Create Industry Development Program for detailed instructions.

Definitions for Supporting Documents Section

Administration Fee. Note: Must be received by the OMDC (payable to OMDC) -

Standard DVD copy of the completed animation (one episode, if a series), or a sampling of the visual effects (if available).

Required Authorization Document: Applicant Declaration Download Declaration form here, sign and return to the OMDC. -

Incorporation documents for the qualifying corporation. Please also provide ay updates, amendments or revisions

Corporate Chart - indicating percentages of shareholdings in the applicant production company, and nationality of shareholders. Note: Please also provide any updates revisions and amendments

If these documents are already on file with OMDC Tax Credits, upload a new version if there have been any changes.

Contract with the producer of the eligible production (or with another qualifying corporation)

OR

where the applicant is the producer or the production services provider, chain of title documentation.

Note: Where there is no contract, please submit the invoice(s). –

List of Employees/Contractors claimed as eligible labour, with job titles and Ontario residency addresses -

Production Schedule - including start and end dates of eligible activities by applicant -

A description of the process by which the animation or visual effects are created, including a list and description of the digital technologies and software used.

Where the producer/production services provider is making an OCASE claim, please provide the following documentation:

(i) Copy of all the VFX services agreements to support the digital component of the producers claim, as well as any change orders to the VFX services agreements.

(ii) Daily Production Reports (DPR’s) and Call Sheets, - for a producer’s OCASE claim you must provide detailed DPR’s and call sheets.

Average VFX Percentage Calculation- Main Unit

Average VFX Percentage Calculation - Second/Splinter Unit

Breakdown/ schedule of eligible Ontario labour expenditures -

The schedules should make a clear distinction between, and provide subtotals for:

| i. | Qualifying Wage Amounts incurred by the qualifying corporation on account of salaries and wages of its employees. | |||||

| ii. | Qualifying Remuneration Amounts (i.e. paid to arm’s length parties who are not employees of the corporation) incurred by the qualifying corporation. | |||||

| Ensure remuneration shows a clear distinction between, and provide subtotals for | ||||||

| o Qualifying Remuneration Amounts paid to Ontario individuals | ||||||

| o Qualifying Remuneration Amounts paid to arm’s length Ontario based individuals through their personal services corporation | ||||||

| iii. | Identify the individual positions being claimed as part of main unit and/or second/splinter unit | |||||

If taxation year includes March 26/09, please provide:

• Schedule of remuneration incurred up to and including March 26/09

• Schedule of remuneration incurred from March 27/09 and on

• Schedule of incorporated labour (paid out to individuals providing freelance services while ensuring that incorporated individuals cannot claim the credit directly) incurred after March 27/09 and on

Financing Plan: Where the applicant is the producer of the production (ie. not under contract to provide VFX or digital animation services), include a copy of all signed distribution, exploitation and financing agreements. Where the applicant is the production services company under contract to the production company, submit the production services agreement.

NOTE: If your company is just providing VFX or digital animation services to the production company / production services provider then financing plans and agreements are not required.

Other Documents - All other supporting documents that are not listed in the document items above can be uploaded here. If you plan on submitting these additional documents through courier/fa/mail, please make note of that in the General Comments field below.

Note: Remember to Save your Application.

Filling out the Calculation of OCASE Estimate Section:

Fill in all the applicable information as shown below.

Definitions for the Calculation of OCASE Estimate Section:

A: Applicant’s Cost to Produce Animation or Effect (Labour & Non-Labour) - The OCASE Guidelines refer to this cost as prescribed costs. See section 90 (11) Taxation Act, 2007 for definition of prescribed cost.

B: Total Ontario Labour Expenditures -

C: Labour Deferrals and/or Assistance Directly in Respect of Labour - See section 90 (11) Taxation Act, 2007 for definition of assistance. If not applicable indicate a value of $0.

D: Eligible Labour for the Production (B-C) -

E: Assistance in Respect of Applicant's Production Cost - See section 90 (11) Taxation Act, 2007 for definition of assistance. If not applicable indicate a value of $0.

F: Eligible Expenditures for the Production D - [E * (B/A)] -

OCASE [F * 20%] -

100% of Salaries/Wages - Generally, this amount is paid to an employee of the corporation and appears on the federal T4 Form (Statement of Remuneration Paid) of the employee.

50% of Remuneration Paid to Unincorporated Individual - The amount paid to freelancers who are individuals or partnerships for expenditures incurred before March 26, 2009 with respect to qualifying activities performed in Ontario.

On or after March 26, 2009 -100% of Remuneration Paid to Unincorporated Individual - The amount paid to freelancers who are individuals or partnerships for expenditures incurred after March 27, 2009 with respect to qualifying activities performed in Ontario.

100% of Remuneration Paid to Incorporated Individual - This includes those who are arm’s-length incorporated individuals, such as personal services corporations with respect to qualifying activities performed in Ontario.

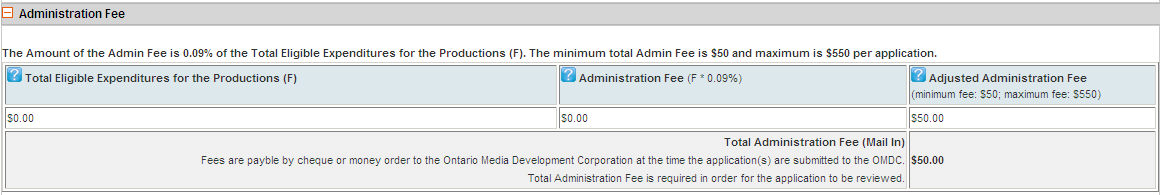

Administration Fee Section:

This section gives a break down of how the Administration Fee works.

Definitions for the Administration Fee Section:

Total Eligible Expenditures for the Productions (F) - This is the total amount in column F of the calculation form.

Administration Fee (F * 0.06%) - The Administration Fee is non-refundable. Automatically calculates the fee as total paid Ontario labour expenditures * 0.06%.

Adjusted Administration Fee (minimum fee: $100; maximum fee: $5000) - Automatically calculates the minimum or maximum fee.

Once you have completed all sections of the Tax

Credit Application, click the  button to submit

your application to OMDC.

button to submit

your application to OMDC.